A selection of the week’s major stories impacting ESG investors, in five easy pieces. This week felt as if everyone was on the move – although not necessarily in the same direction. Moving out – The decision by State Street Global Advisors (SSgA) and JP Morgan Asset Management to quit Climate Action 100+ (CA100+), a coalition of investors engaging with…

Industrial Decarbonization Startup Celadyne Raises $4.5 Million to Accelerate Production, Use of Hydrogen

Hydrogen technology startup Celadyne announced today that it has raised $4.5 million in seed capital, with proceeds supporting the company’s solutions aimed at enabling industrial and transport decarbonization. Founded in 2018 by Gary Ong, Chicago-based Celadyne provides hydrogen solutions to the energy industry, working with fuel cell and utility companies to provide materials and technologies to convert hydrogen into usable…

The B in ESG – Part 2: Regulatory Drivers

Dr Anthony Kirby, Head of Regulation and Risk for Asset Management and Capital Markets in Europe at EY, places the TNFD framework in context of regulatory and political developments. The UK is one of 12 jurisdictions around the world that already include or plan to include nature-related aspects in their environmental taxonomies. This broadly commits them to regulatory approaches which incorporate nature-relevant environmental objectives…

Oregon Leads Way on US Climate Plans

OPERF announces intention to reach 60% emissions reduction by 2035, with other US state initiatives expected to follow. The Oregon State Treasurer disclosed plans earlier this month to transition the Oregon Public Employees Retirement Fund’s portfolio (OPERF) to net zero, as more US states prepare to launch transition plans for their public pension funds. Dave Wallack, Executive Director of US…

Google, Embraer Join United Airlines’ $200 Million Sustainable Aviation Venture Fund

United Airlines announced today the addition of several new corporate partners to its its sustainable aviation fuel (SAF)-focused investment fund, the United Airlines Ventures (UAV) Sustainable Flight Fund, bringing the capital committed to the fund to over $200 million. The new partners include Aircastle, Air New Zealand, Embraer, Google, HIS, Natixis Corporate & Investment Banking, Safran Corporate Ventures, and Technip…

Goldman Sachs AM Launches Global Green Bond ETF

Goldman Sachs Asset Management announced today the launch of the Goldman Sachs Global Green Bond UCITS ETF, a new Article 9 fund tracking a bespoke index developed with Solactive, tracking the performance of investment-grade bonds denominated in G10 currencies. The new ETF comes follows several years of growth in green bond issuance, as corporate and government issuers move to finance…

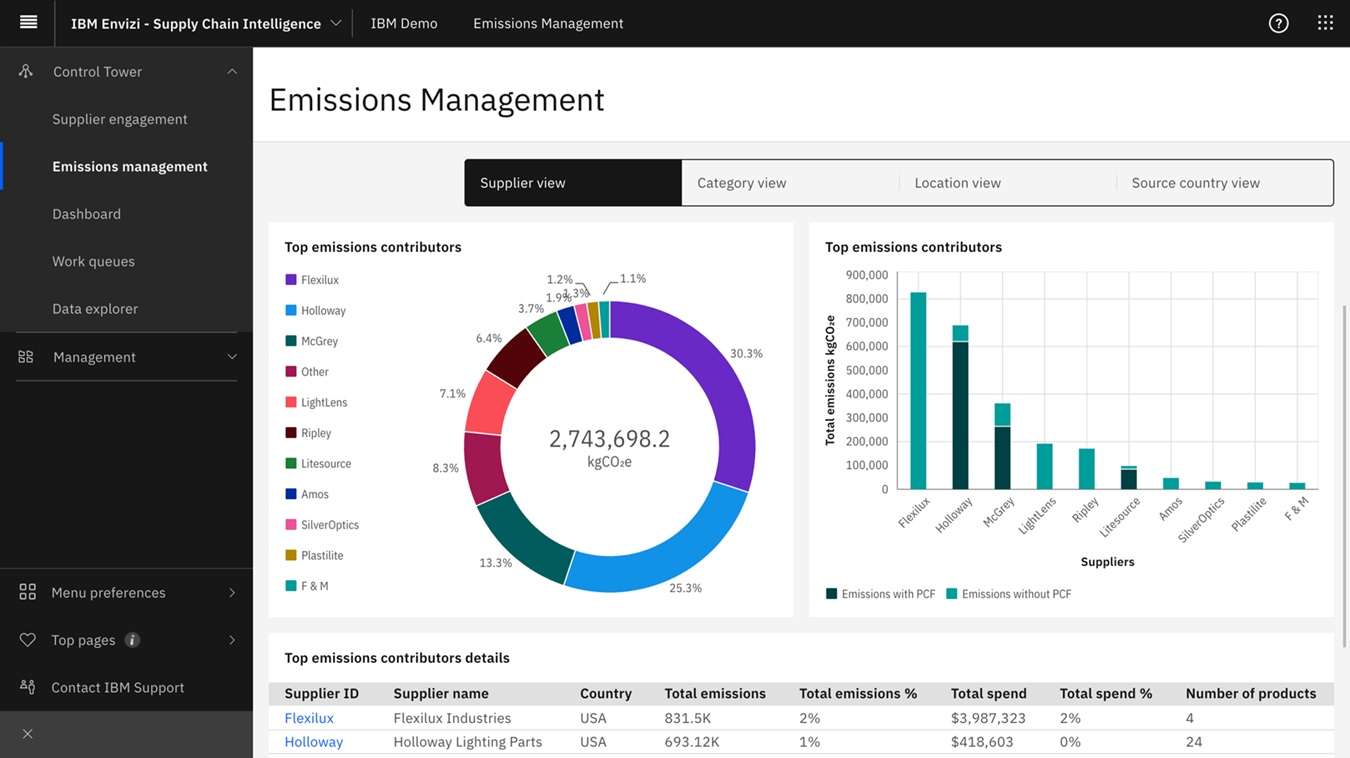

IBM Adds Supply Chain Emissions Data Capabilities to ESG Platform

IBM announced the launch of a new Supply Chain Intelligence module in its ESG data collection, analysis and reporting platform IBM Envizi ESG Suite, adding capabilities for companies to collect and analyze supply chain emissions for Scope 3 calculation and reporting. The new features come as companies globally face increasing regulatory pressure to report on their Scope 3 emissions, or…

Guest Post: Can Today’s CSO Become Tomorrow’s CEO?

Reflecting on recent global climate change conferences, where businesses and governments alike identified the need for radical transformation, Dr. Matthew Bell, EY Global Climate Change and Sustainability Services Leader, questions why more sustainability leaders aren’t mapping out their own career paths to become future chief executive officers (CEOs). I was inspired by a personal revelation in a recent EY survey,…

JPMorgan AM Exits Climate Action 100+

JPMorgan Asset Management (JPMAM) has withdrawn from Climate Action 100+, a climate-focused investor network focused on engaging with companies to reduce their greenhouse gas emissions and implement climate transition plans. According to a statement from a JPMAM spokesperson, the firm’s decision follows the development of its internal engagement capabilities, allowing the company to act on its own. The spokesperson said:…

AI Tools Can Tackle Opaque ESG Data

Bridgewise’s AI-powered analysis toolkit adds to technologies addressing unstructured data, amid ever-growing reporting requirements. Industry experts have highlighted the key role that artificial intelligence (AI) tools can play in consolidating and enhancing ESG data, despite governance concerns marring the technology. According to estimates, up to 90% of data generated globally each day – including on sustainable finance – is unstructured….