On October 8 2024, Brazil enacted Federal Law No. 14,993/2024, which stems from Bill No. 528/2020, the “Fuels of the Future Bill.” The new law, which addresses several matters related to decarbonization, provides for the regulation and inspection of activities involving the capture and geological storage of carbon dioxide, also known as CCS (Carbon Capture and Storage)—the first Brazilian framework…

Vacuum Threatens UK Sustainability Assurance Market

Calls to regulate the sector increase amid competition and quality concerns highlighted by the Financial Reporting Council. A continued absence of regulation could stymie the development of the UK sustainability assurance market, exacerbating a lack of consensus on how services should be provided and by whom. Key areas in need of resolution include which body should be tasked with overseeing…

Redaptive Raises $100 Million to Scale Energy-Saving Decarbonization Solutions

Energy-as-a-Service solutions provider Redaptive announced today that it has raised $100 million through an equity investment from the Canada Pension Plan Investment Board (CPP Investments). Founded in 2015, Denver-based Redaptive helps organizations to reduce energy waste, lower costs and cut emissions, with a focus on large Commercial & Industrial companies. The company provides a solution to manage long-term energy efficiency…

Universal Fuel Technologies Raises $3 Million for Solution to Cut Sustainable Aviation Fuel Production Cost in Half

California-based Universal Fuel Technologies (Unifuel), which is developing technology to cut sustainable aviation fuel (SAF) production costs, announced that it has raised $3 million for the advancement of its projects, as well as for lab space in Texas. Fuel accounts for the vast majority of the aviation sector’s emissions. Generally produced from sustainable resources, like waste oils and agricultural residues,…

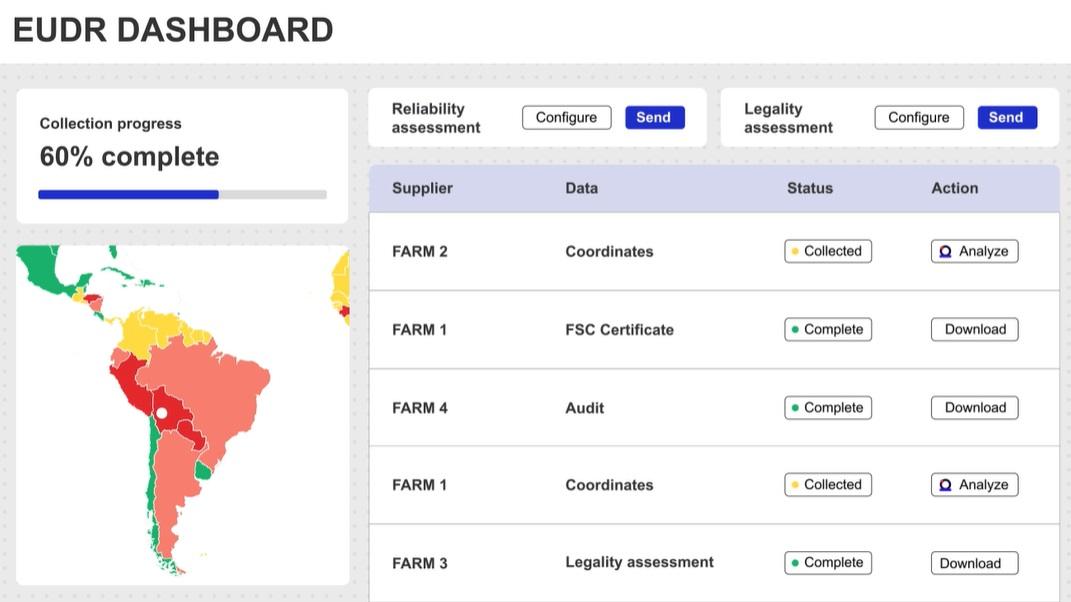

TrusTrace Launches EUDR Deforestation Regulation Compliance Solution

TrusTrace, which provides a digital platform for product traceability and supply chain transparency, announced today the launch of a new Deforestation Compliance Solution aimed at supporting companies on complying with the requirement to provide deforestation-free shipments ahead of the implementation of The Regulation on Deforestation Free Products (EUDR). The EUDR was initially introduced by the EU Commission in November, 2021,…

Mirova Wins Mandate to Manage New €100 Million Biodiversity Fund

Sustainable investing firm Mirova announced that it has been selected to manage “Objectif biodiversité” a new fund launched by a consortium of French institutional investors, targeting investments in businesses transitioning to sustainable business models and in innovative solutions for biodiversity preservation. The fund, with over €100 million and an initial duration of 5 years, will primarily focus on small and…

SEC Fines WisdomTree $4 Million for Investing in Fossil Fuels and Tobacco in ESG Funds

The U.S. Securities and Exchange Commission (SEC) announced that it has charged ETF provider and asset manager WisdomTree with making misstatements and compliance failures after finding that funds marketed by the firm as incorporating ESG factors failed to comply with their own criteria, by investing in companies involved in fossil fuel and tobacco activities. According to the SEC and a…

Hong Kong Tells Banks to Target Net Zero Financed Emissions, Disclose Climate Risks and Opportunities

The Hong Kong Monetary Authority (HKMA), Hong Kong’s central banking institution, announced the launch of its Sustainable Finance Action Agenda, setting out a series of finance sector-focused targets and planned actions to support green and sustainable financing needs to support the low carbon transition and to establish Hong Kong as a “sustainable finance hub” in the region. Among the key…

Carbon Metrics Key to Investors’ Net Zero Path

Invesco, AP4 evaluate various methods to quantify portfolio emissions, reflecting investors’ appetite to move away from a purely backward-looking approach. Choosing the right metric to measure portfolio emissions is crucial to investors’ alignment with the Paris Agreement, and should reflect their chosen goals and strategy. This is according to a study by global asset manager Invesco and Sweden’s fourth national…

Investors Face Rising Tide of Water Risks

Scottish Widows flags the breadth of exposure facing asset owners as water stress weighs on global GDP. Water poses a growing systemic risk throughout investment portfolios and across developed and emerging markets, according to a spate of recent reports, demanding increasingly urgent action by asset owners and managers. UK-based Scottish Widows – a life insurance and pensions company owned by…