As sustainability continues to dominate corporate agendas, oil and gas companies are under increasing pressure to integrate sustainability metrics into their financial reporting. For sustainability managers, this is a complex task requiring a balance between regulatory compliance, investor expectations, and profitability. Here’s a step-by-step guide to help you navigate this process effectively.

Invesco and Castlefield drop ESG-related terms in fund names

Invesco has informed shareholders of a number of fund name changes effective from 24 March 2025, in which they substitute the terms ‘sustainable’ and ‘responsible’ to comply with the EU’s Sustainable Finance Disclosure Regulation (SFDR). According to a letter sent to shareholders on 20 January, the Invesco Sustainable Eurozone Equity fund will be known as the Invesco Transition Eurozone Equity…

Invesco and Castlefield drop ESG-related terms in fund names

Invesco has informed shareholders of a number of fund name changes effective from 24 March 2025, in which they substitute the terms ‘sustainable’ and ‘responsible’ to comply with the EU’s Sustainable Finance Disclosure Regulation (SFDR). According to a letter sent to shareholders on 20 January, the Invesco Sustainable Eurozone Equity fund will be known as the Invesco Transition Eurozone Equity…

Invesco and Castlefield drop ESG-related terms in fund names

Invesco has informed shareholders of a number of fund name changes effective from 24 March 2025, in which they substitute the terms ‘sustainable’ and ‘responsible’ to comply with the EU’s Sustainable Finance Disclosure Regulation (SFDR). According to a letter sent to shareholders on 20 January, the Invesco Sustainable Eurozone Equity fund will be known as the Invesco Transition Eurozone Equity…

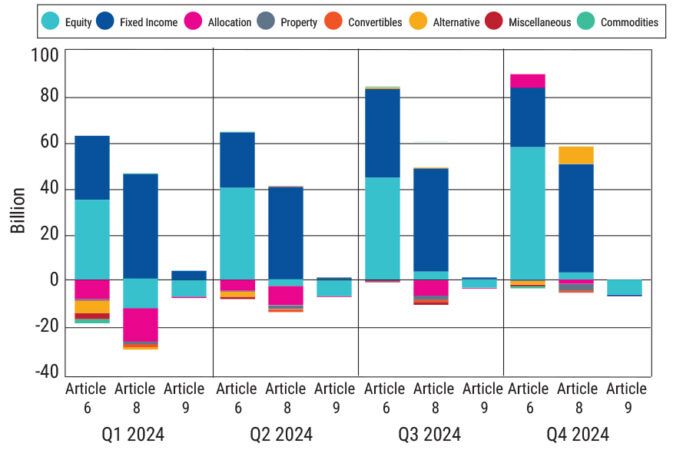

Bond appetite nudges Article 8/9 AUM higher in Q4

Appetite for fixed income funds drove the highest inflows of the year into Article 8 funds in the final quarter of 2024, according to the latest SFDR update from Morningstar Sustainalytics. While it wasn’t a good year for equity funds in Article 8 and Article 9 funds, bond funds dominated flows particularly in the fourth quarter as investors sought the…

Relying solely on ESG scores ‘doesn’t ensure alignment with do no harm principles’

Applying exclusion screens can improve the weighted average ESG scores of indices, indicating that exclusions can complement ESG integration by refining portfolio quality without detracting from ESG performance, according to the latest study conducted by researchers from the EDHEC Business School. The study – Do ESG Scores and ESG Screening Tell the Same Story? Assessing their Informational Overlap – examines…

The Role of Sustainability Metrics in Shaping the Future of Oil and Gas

The oil and gas industry is at a pivotal moment. With global attention on climate change, social responsibility, and governance practices, companies in this sector face growing pressure to evolve. But how can oil and gas companies navigate these challenges while ensuring long-term success? The answer lies in sustainability metrics.

The Role of Sustainability Metrics in Shaping the Future of Oil and Gas

The oil and gas industry is at a pivotal moment. With global attention on climate change, social responsibility, and governance practices, companies in this sector face growing pressure to evolve. But how can oil and gas companies navigate these challenges while ensuring long-term success? The answer lies in sustainability metrics.

How Sustainability Managers Can Integrate Sustainability Metrics into Financial Reporting Without Compromising Profitability

The oil and gas industry faces growing pressure over its environmental and social impact, making it essential for companies to adopt sustainable practices. For sustainability managers operating in the UK, EU, and Middle Eastern markets, integrating sustainability metrics into financial reporting is a strategic way to meet regulatory requirements, satisfy investors, and enhance long-term profitability. In this blog we outline…

Political Appetites Pushing EU Omnibus Agenda

French and German retrenchment and lack of due process risk reduction in transparency to the detriment of investors. EU member states and businesses are driving the direction of the looming omnibus package of sustainable finance reforms, with the desire to ‘streamline’ legislation overriding investor interests. France’s government has called for an indefinite delay to a key piece of legislation, the…