London Climate Action Week: Are we still on track for net zero by 2050?

As London Climate Action Week gets underway, it’s time to ask a hard question: are we still on track for net zero by 2050? On the surface, the momentum is holding. Clean technology costs continue to fall — forecast to drop another 2–11% in 2025 — bringing the total cost of net zero down by an estimated 73% versus original projections. UK emissions dropped 3.6% in 2024, and capital flows remain strong, with corporates planning a 34% increase in clean energy capex next year. Regulatory clarity is also improving, with new global standards such as IFRS-ISSB sharpening transparency and data quality.

But headwinds persist. Several oil and gas giants have softened their ambitions, the US political climate is creating uncertainty, and global emissions rose 0.8% last year—an uncomfortable reminder of the scale of the task.

See also: Liquid assets: Why tomorrow’s investment returns depend on today’s water security

So, are we on track? Realistically, not yet. The current policy mix still falls short of a 1.5°C pathway. But with 39% of global market capitalisation now covered by science-based targets, growing investor pressure, and increasingly attractive economics for clean tech, there are grounds for cautious optimism. The route to net zero by 2050 is narrowing – but it’s still open.

How is the asset management industry aligning?

The 2030 targets are crucial milestones on the path to net zero by 2050, creating the urgency and direction needed to accelerate near-term emissions reductions and prevent crossing tipping points that would lock in the most severe impacts of climate change.

To understand how the asset management industry is responding, we reviewed 42 fund managers included in our investment solutions. All of them have made net zero commitments covering their Scope 1 and 2 emissions, and they are at varying stages of understanding and setting commitments for their Scope 3, Category 15 emissions.

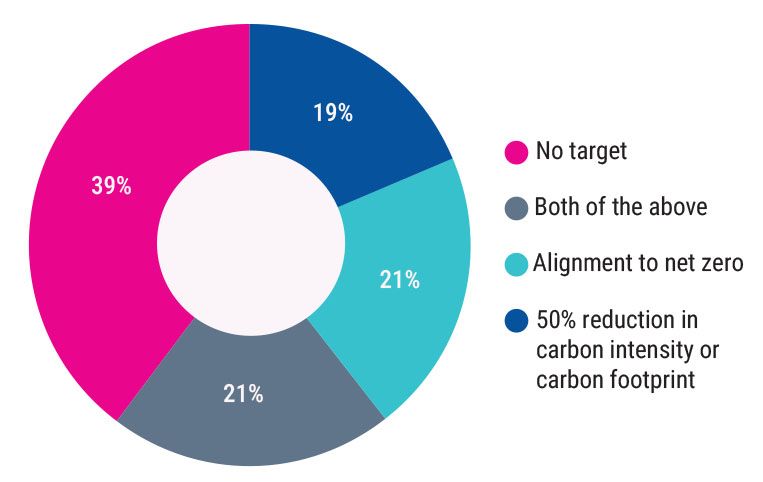

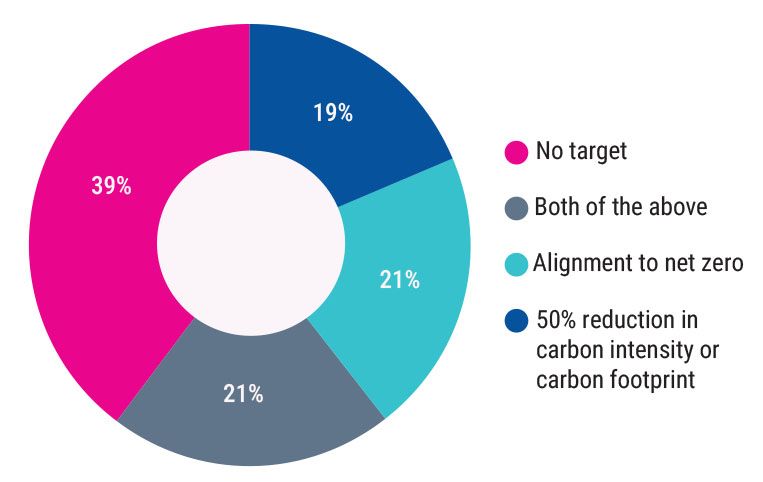

In this sample group of 43 asset managers, including Hargreaves Lansdown’s own approach, when assessing their 2030 targets:

- 19% have set backward-looking carbon intensity or footprint targets

- 21% use forward-looking net zero alignment commitments

- 21% blend the above two approaches

- 40% have no clear target in place for their financed emissions

2030 financed emissions targets

Backward-looking targets are quantifiable and portfolio-wide but risk overstating progress if emissions fall only due to portfolio changes or revenues shift. Alignment strategies support real-world impact by backing firms transitioning today, but demand rigorous, bottom-up analysis.

What’s clear is that engagement is now the dominant strategy. We’re seeing engagement move from pushing companies to set net zero targets, to focusing on ensuring firms have credible transition plans to support these targets. Most managers are integrating climate risk into decision-making, excluding the worst offenders like oil sands and thermal coal, and pushing companies to decarbonise faster.

We expect the number of managers without targets to fall as regulatory pressure mounts. Frameworks like the Taskforce on Climate-related Financial Disclosures and ISSB standards are nudging more firms to set — and disclose — credible transition targets.