Rathbones amends objectives on sustainable multi-asset to align with SDR labels

Rathbones Asset Management has made changes to its four sustainable multi-asset funds to achieve SDR labels across the range.

The group has announced it has “better defined” the sustainable objectives of each fund to support SDR – the UK regulator’s Sustainability Disclosure Requirements. It has removed a suggestion that the non-financial objective of the funds is to “improve the sustainability characteristics” of the stocks in the portfolio.

See also: Rathbones adopts ‘Sustainability Focus’ label on two funds

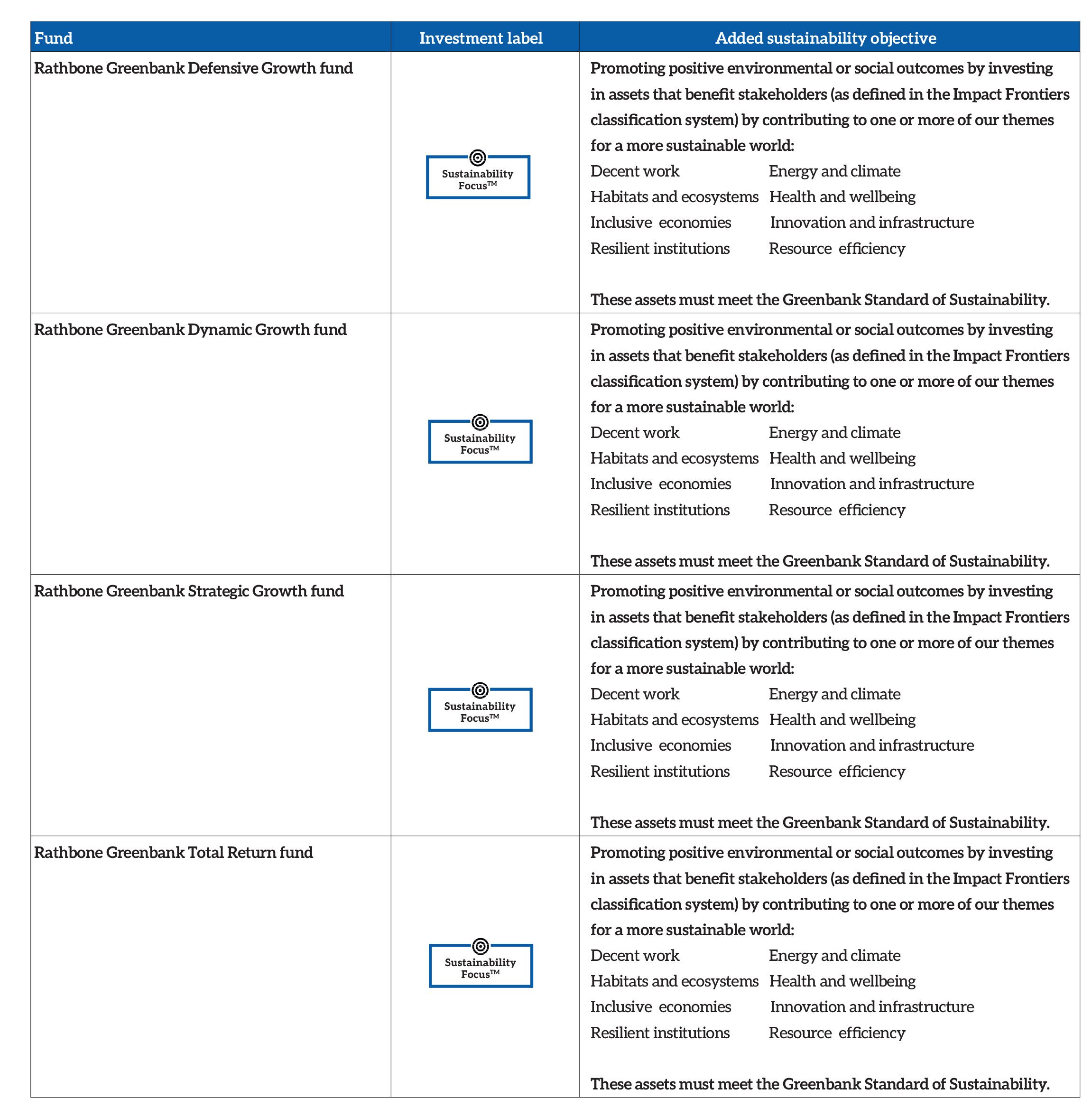

As a result, the four funds have achieved the Sustainability Focus label. The four funds are:

- Rathbone Greenbank Total Return Portfolio

- Rathbone Greenbank Defensive Growth Portfolio

- Rathbone Greenbank Strategic Growth Portfolio

- Rathbone Greenbank Dynamic Growth Portfolio

Full details of the changes are outlined in the table below:

Tom Carroll, chief executive of Rathbones, said: “At a time when it is fashionable to talk down sustainability, we are pleased to be able to demonstrate our long-term commitment to this area of the market.

“We are proud of the hard work we have done to ensure SDR recognition for our funds, putting us in the leading tier of asset management companies for the number of labelled funds relative to AUM.”

In March, the group announced it had adopted the Sustainability Focus label on its Rathbone Greenbank Global Sustainability fund and Rathbone Greenbank Global Sustainable Bond fund.

This article originally appeared in our sister publication, Portfolio Adviser