City Hive has announced six new asset management names has signed up to the ACT framework; Fidelity International, Marlborough Group, PGIM, Principal Asset Management, Rebalance Earth and Robeco Asset Management. The groups join the ACT List, a line-up of organisations dedicated to embracing transparency in corporate culture and value. There are now 34 signatories on the list representing £12trn in…

Water, water everywhere – but we should stop and think

Like many of my elderly millennial colleagues, I was subjected to the mass memorisation and recital of poetry. The Rime of the Ancient Mariner lingers in the memory more than most. In case your education sadly lacked exposure to Samuel Taylor Coleridge, the protagonist and his shipmates find themselves shipwrecked with no fresh water, surrounded by the sea they cannot…

Tikehau Raises Over €1 Billion for Egis to Decarbonize Transport, Cities, Energy

Paris-based alternative asset management Tikehau Capital announced the launch of a new continuation fund for its climate-focused architectural, consulting, construction engineering, operations and mobility services portfolio company Egis, raising more than €1 billion (USD$1.2 billion) to support the company’s next phase of growth. Based in France, Egis designs, develops and operates smart infrastructure and buildings that address climate change challenges,…

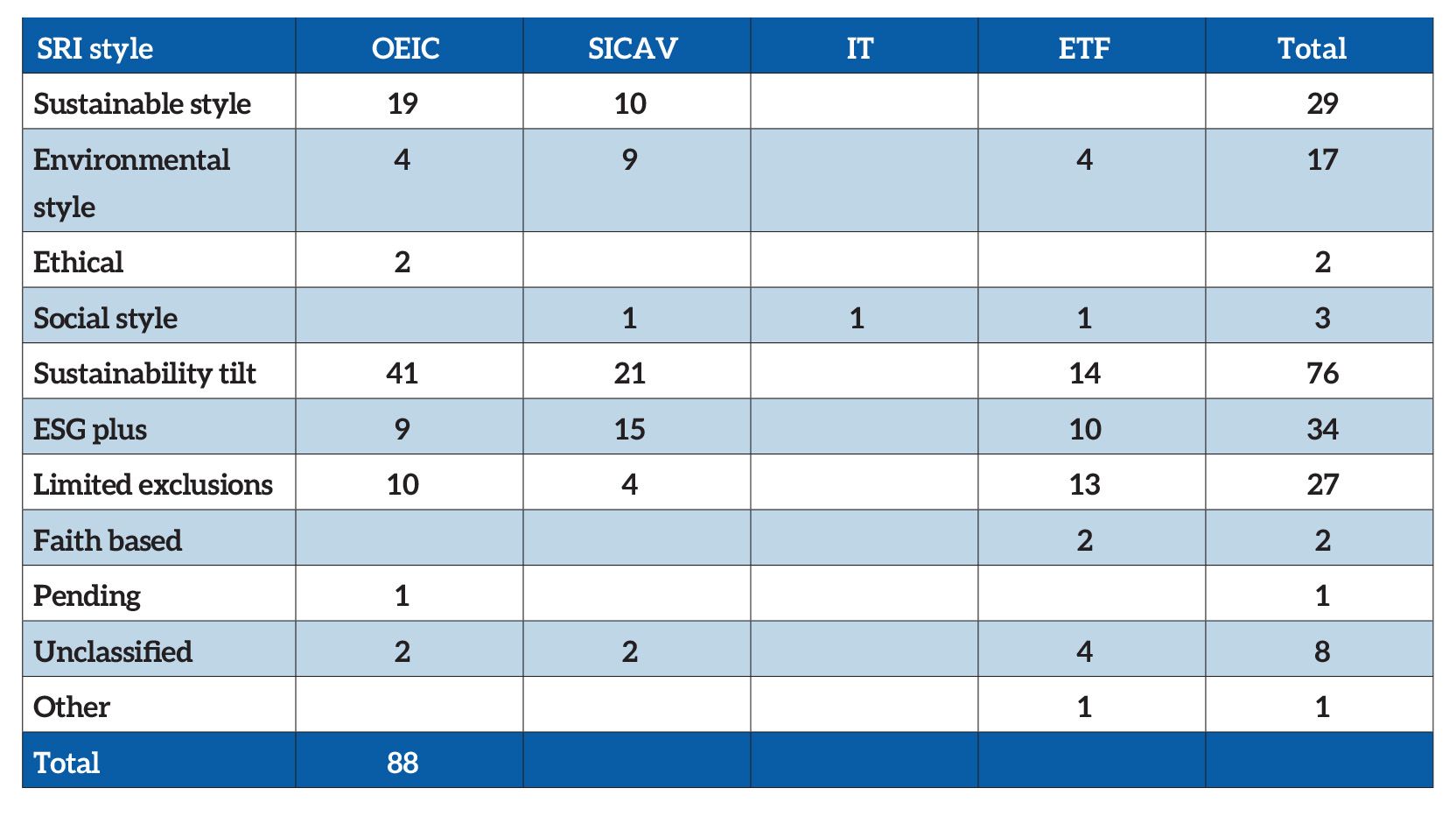

UK retail sustainable fund changes: Assessing the impact of SDR in the first half of 2025

If you have found your head somewhat spinning when thinking about sustainable investment (and related) fund options recently you are not alone… The following analysis highlights changes in UK the sustainable, responsible and ethical fund market during the first half of 2025, when the Sustainability Disclosure Regime (SDR)’s naming and marketing rules came into force. So far this year we…

What does the ‘new’ flexible working look like?

Five years ago, the world was adjusting to remote working after being instructed to ‘stay at home, save lives’. The Covid 19 pandemic meant governments laid down rules encouraging workers to avoid travelling to the office where possible. A new dawn emerged with many firms embracing flexible working practices even after social distancing rules were relaxed – businesses could adapt and cope…

Quilter Cheviot rebrands Climate Assets fund

Quilter Cheviot has renamed its Climate Assets fund range after securing a ‘Sustainability Focus’ label as part of the Financial Conduct Authority’s (FCA) Sustainability Disclosure Requirements (SDR) regime. The range, which consists of Balance and Growth mandates, will be rebranded as Quilter Cheviot Sustainable Opportunities, from 8 September. Claudia Quiroz, head of sustainable investment at Quilter Cheviot and lead manager of the funds,…

CapitaLand Launches New Framework to Quantify the Financial Return of Sustainability Investments

Singapore-based real estate investment manager CapitaLand Investment (CLI) announced the launch of its new “Return on Sustainability (RoS) framework,” aimed at quantifying the financial value of green capital expenditure. The new tool has been established at a time when expectations shift from climate pledges to demonstrable results. Featured in CLI’s latest Global Sustainability Report, the framework has been developed using…

ESMA Guides Issuers, Fund Managers on Anti-Greenwashing Expectations

EU markets regulator the European Securities and Markets Authority (ESMA) announced the release of a new thematic note aimed at guiding market participants including issuers and fund managers on its expectations for sustainability-related claims, and avoiding greenwashing risks in investor communications. Marking the first in a series of thematic notes, the new publication focuses on ESG credentials, or claims made…

Mars Launches $250 Million Sustainability Solutions Fund

Snacking, food, and pet care products provider Mars announced the launch of the Mars Sustainability Investment Fund (MSIF), a new $250 million fund aimed at providing capital to companies developing solutions to address key industry sustainability challenges. According to Mars, the new fund will deploy capital across investment funds as well as through direct investments, targeting solutions to sustainability challenges…

EU Launches Major Simplification of Sustainability Taxonomy to Ease Compliance Burden on Companies

The European Commission announced the adoption of a series of measures aimed at simplifying the application of the EU Taxonomy, and reducing the administrative burden on companies, including dramatically reducing the number of datapoints in the taxonomy’s reporting templates, and exempting companies from assessing taxonomy alignment for non-material activities. The simplification measures come amidst a major push by the EU Commission to…