The Financial Reporting Council (FRC) must be “open to change” and accept the cultural shift in stewardship efforts in its consultation of a revision of the code, according to a panel at the at the Investment Association (IA)’s Stewardship & Corporate Governance forum last week. Moderated by Andrew Ninian, director of stewardship risk and tax at the IA, the panel…

EM Blended Finance Fund Sees Soaring Investor Demand

Mirova seeks to support SDGs with investments in Global South agriculture and agroforestry underway. Mirova’s Sustainable Land Fund 2 (MSLF2) is on track to hit its €350 million (US$363.4 million) fundraising target two years ahead of schedule, with institutional investor interest a key driver. The French asset manager’s blended finance fund focused on sustainable land use in the Global South reached €100…

Advisers maintain ESG commitments as industry evolves

The conversation around ESG investing has undoubtedly become more polarised lately. Once uncontroversial and seen as a force for good, it is sometimes now the subject of scepticism and political controversy on the one hand and concerns over greenwashing on the other. Some asset managers – especially US-based – have also left the important industry-wide climate alliances, due to perceived…

Young people want to see authenticity around financial firms’ social claims

Young people in the UK have said financial firms have an important role to play in driving progressive societal change but must do so in an authentic way with words that are followed up with action, according to MRM’s inaugural Young Money Report. The report – Guidance not Gratification: Why financial services needs to reclaim its finfluence, surveyed 1,000 UK-based…

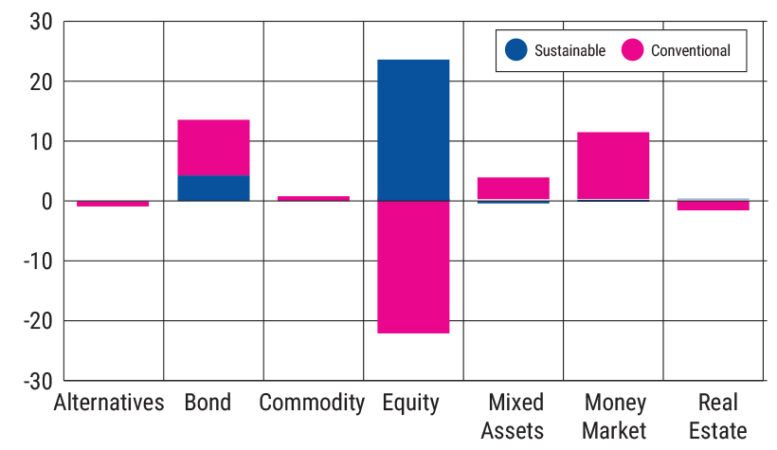

Shakeout: Resetting sustainable investors’ expectations

Headlines are grim for sustainable investments. But headlines are frequently misleading. To paraphrase Mark Twain, the figures suggest reports of its death may be somewhat premature. First of all, though, a caveat: how one defines “sustainable” greatly affects the calculation, as does the market on which one focuses. Here I’m focusing on the UK market, with a rather restricted definition…

“Tougher” Stewardship Needed from UK Pensions

Campaign group accuses big name providers of “lethargy” on climate and nature action. An assessment of large UK pension providers has found that existing stewardship efforts are falling short of driving positive climate- and nature-related performance across their portfolios. UK-based campaign group Make My Money Matter (MMMM) has published a report analysing the country’s 12 largest pension providers on…

“Tougher” Stewardship Needed from UK Pensions

Campaign group accuses big name providers of “lethargy” on climate and nature action. An assessment of large UK pension providers has found that existing stewardship efforts are falling short of driving positive climate- and nature-related performance across their portfolios. UK-based campaign group Make My Money Matter (MMMM) has published a report analysing the country’s 12 largest pension providers on…

Microsoft Sources Renewable Energy from New U.S. Solar Projects in Texas, Illinois

Clean energy developer EDP Renewables North America (EDPR NA) announced the delivery of three new solar projects in Illinois and Texas totalling 400 MW, with Microsoft purchasing 389 MW of electricity and renewable energy credits (RECs) from the projects through long-term virtual power purchase agreements (VPPAs). The three new projects include the 140 MW Wolf Run Solar Project, and the…

Arcadia Acquires Clean Energy Procurement Platform RPD Energy

Energy management platform Arcadia announced the acquisition of RPD Energy, which markets renewable electricity primarily to large commercial and industrial customers. Terms of the deal were not disclosed. Launched in 2014, Washington D.C.-based Arcadia provides energy data and management solutions, including community solar subscriptions, enabling homes and businesses to access renewable energy without needing to install solar panels by connecting…

StormFisher Hydrogen Raises $50 Million to Produce Clean Fuels for Hard to Abate Sectors

e-Fuels project developer StormFisher Hydrogen announced that it has secured a $50 million investment from Hy24’s Clean Hydrogen Infrastructure Fund, with proceeds aimed at accelerating its pipeline of clean fuel production projects in North America. Founded in 2006, Houston-based StormFisher Hydrogen develops and operates production facilities that produce e-Fuels, providing clean fuel solutions to help decarbonize hard-to-abate industrial sectors. The…