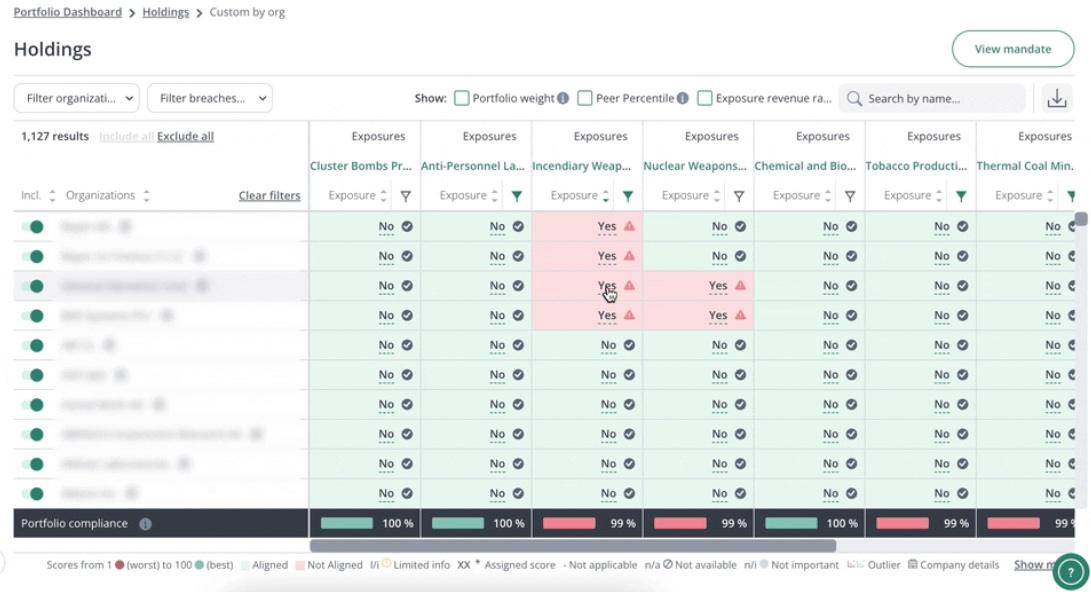

Sustainability technology company Clarity AI announced the launch of a new tool aimed at helping fund managers to market products aligned with new sustainable investment naming rules, labels and standards across Europe. The new solution comes as regulators and lawmakers across Europe launch a series of new labelling rules for sustainability-focused funds, aimed at addressing the proliferation of ESG-related financial…