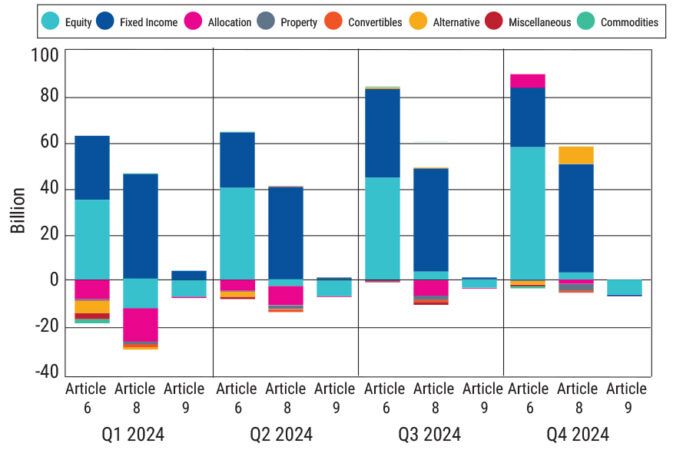

Global sustainable investment fund flows rebounded sharply in the fourth quarter of 2024, as stronger flows into sustainable funds in Europe more than offset an increased pace of outflows in the U.S., although full year inflows overall remained well below 2023 levels, according to a new report released by ESG ratings, data, and research provider Morningstar Sustainalytics. For the quarterly…