Through active ownership, investors can promote a more systemic approach, according to Anna Warberg, Engagement Director at the Council on Ethics for the Swedish National Pension Funds. Escalating water challenges are threatening economies and businesses across the globe. More than 30% of global GDP will likely be exposed to high water stress by 2050. This is exposing companies to growing…

S&P Global Launches Climate Center of Excellence Focused on Climate, Environmental, and Nature Research

Market data and solutions provider S&P Global announced the launch of its new S&P Global Climate Center of Excellence, aimed at advancing the company’s research and methodology development in areas including climate, environmental, and nature. Sitting within S&P’s sustainability-focused unit, S&P Global Sustainable1, the new center will include scientists and strategists, and will collaborate across the company’s divisions “to ensure…

World “Lagging” on Just Transition

Panellists warned PRI in Person delegates against the risk of stranded assets, insisting on the need to prepare society for challenges to come. Progress is heterogeneous. Canada is lagging. The world is lagging. Those were some of the warnings issued by panellists during a session at this year’s PRI in Person in Toronto examining how to achieve a just transition…

World “Lagging” on Just Transition

Panellists warned PRI in Person delegates against the risk of stranded assets, saying society should be prepared for challenges to come. Progress is heterogeneous. Canada is lagging. The world is lagging. Those were some of the warnings issued by panellists during a session at this year’s PRI in Person in Toronto examining how to achieve a just transition in emerging…

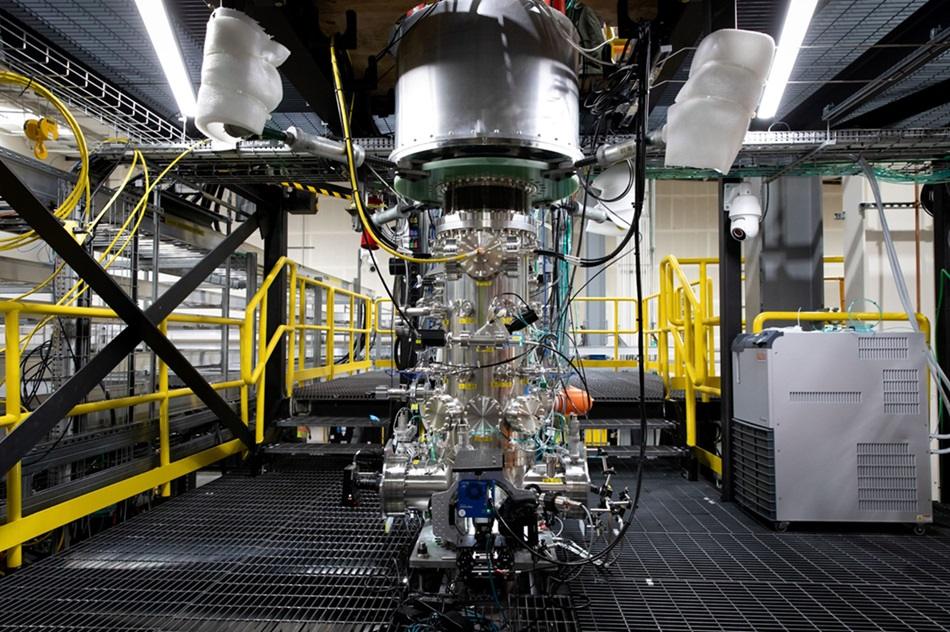

Fusion Reactor Startup Zap Energy Raises $130 Million

Zap Energy, which is developing a commercially-viable fusion energy system, announced that it has raised $130 million in a Series D round, with proceeds to be used to advance the company’s efforts to build a commercial fusion power plant. The company also announced that it has begun operations of Century, its new high-rep-rate, liquid-metal-cooled fusion test platform.ֿ Fusion, the process…

Corporate Giants: Balancing Purpose with Profit

In today’s corporate landscape, leadership in Sustainability is no longer a secondary player. You’re in the boardroom, navigating the fine line between purpose and profit, wielding influence over not just ESG strategies but core business decisions. But this power comes with intense scrutiny—from shareholders questioning ROI, to customers demanding authenticity, to regulatory bodies mandating ever stricter compliance. The stakes are…

Investors Told to Embed Sustainability at PRI Event

Factors must be fully integrated if investments in public and private markets to support early-stage firms and those in transition. Sustainability cannot be sidelined and must be integrated into investors’ core investment practices, according to investors speaking at the PRI in Person conference. “If sustainability is seen as an adjacent activity to traditional investment practices, then it’s never going…

“Insufficient” Action from Banks to Meet Climate Targets

Lenders are urged to end fossil fuel expansion and convert targets into “meaningful commitments” as US banks fall behind international peers. Action by banks to reach net zero emissions and meet climate goals is “insufficient”, according to two reports which also highlight significant gaps in the policies guiding the sector’s transition. US-based environmental non-profit Sierra Club’s report examined the interim…

Climate Tech Startup Paebbl Raises $25 Million to Turn Captured CO2 into Building Materials

Decarbonization technology company Paebbl announced that it has raised $25 million in a Series A funding raise, with proceeds to be used to scale up its technology turning captured CO2 to carbon-storing construction materials. Founded in 2021, Rotterdam-based Paebbl has developed a system to speed up the natural process of CO2 mineralization – where minerals inside rocks react with atmospheric…

UK Launches Cap and Floor Scheme to Support Energy Storage Investment

The UK government announced today the launch of a new scheme aimed at helping to build long duration energy storage capacity by enabling investment in critical infrastructure. Energy storage forms one of the major building blocks for the rapidly expanding clean energy transition, given the intermittent generating nature of many sources of renewable energy, such as wind and solar, and…