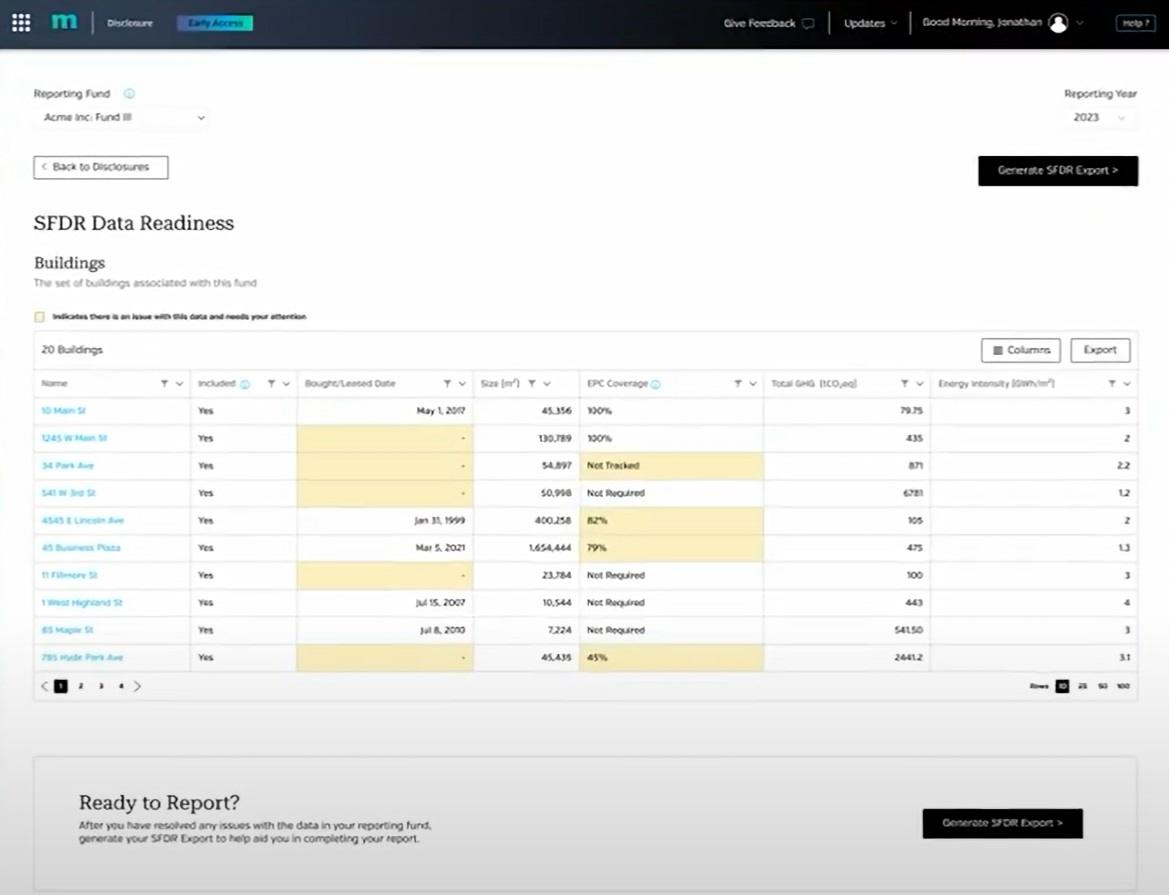

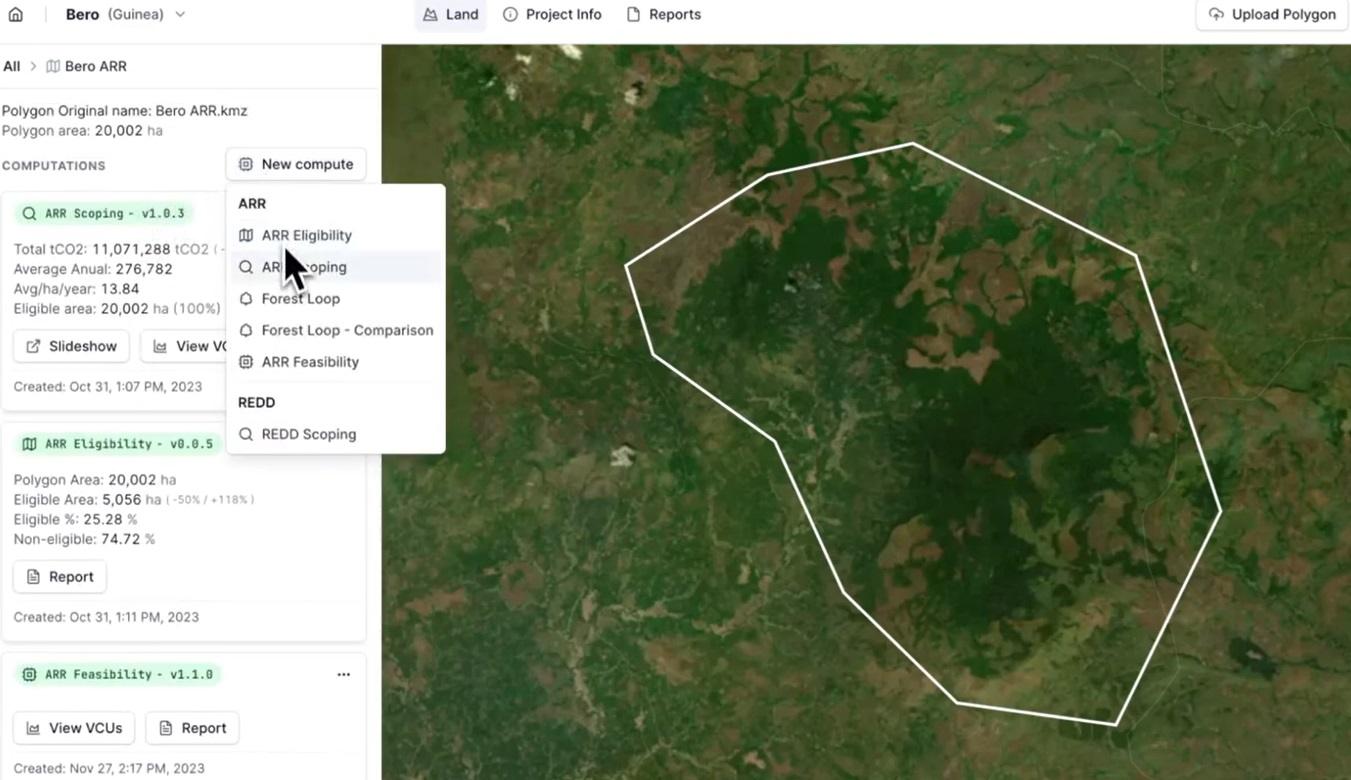

Real estate-focused ESG data technology provider Measurabl announced today the launch of a new suite of software products aimed at enabling real estate owners, operators, and investors to collect, manage, analyze and report on sustainability data across their building portfolios. Founded in 2013, San Diego-based Measurabl provides a data management platform enabling commercial, residential and corporate real estate owners and…