Climate-focused transactions are also on the rise, but private investors’ efforts have been limited by data availability. Catalytic capital flows to de-risk projects centred around sustainable agriculture, renewable energy, and health and education projects across emerging markets (EMs) have increased in 2023 after a ten-year lull. According to blended finance network Convergence’s latest State of Blended Finance report, the market…

McKinsey, JPMorgan, Alphabet & Others Sign $58 Million Biomass-Based Carbon Removal Deal Through Frontier

Carbon removal buyer coalition Frontier announced that it has facilitated a new set of carbon removal agreements totaling more than $58 million with biomass carbon removal and storage (BiCRS) provider Vaulted Deep, on behalf of a group of corporate buyers that include Stripe, Alphabet, McKinsey, H&M and JPMorgan Chase, among others. Under the new agreements, Vaulted Deep will remove and…

Church Commissioners’ Planet Lead to Heighten Engagement Efforts

In her new role, Laura Moss-Bromage will develop a coherent strategy focusing on climate change, nature loss and social inequality. The Church Commissioners for England has appointed Laura Moss-Bromage as Planet Lead – a new role created as the organisation looks to bolster engagement with companies and policymakers on climate change and biodiversity. “My responsibilities will be designing and implementing…

Carbonfact Raises $15 Million for Emissions Reporting Solution for Fashion Industry

Carbon management software startup Carbonfact announced that it has raised $15 million with proceeds from the financing aimed at supporting its solutions to help the fashion industry automate environmental data collection and reporting. Founded in 2021, Paris, France-based Carbonfact provides solutions for apparel, luxury, and footwear brands measure, report and reduce emissions, and to meet regulations such as the EU’s…

Transition Plans & Real Estate

In a survey carried out by HSBC in 2023, 97% of real estate developers and investors said net zero was important to their business and 59% of the largest real estate companies said net zero was their top priority. A third of companies in the sector already have Transition Plans and the push for formalising Transition Plans across the sector…

Goldman Sachs Acquires Environmental Risk Reduction Services Provider Adler & Allan

Goldman Sachs Asset Management’s alternative investment platform Goldman Sachs Alternatives announced an agreement to acquire UK environmental risk reduction specialist Adler & Allan from private investment advisory firm Sun European Partners. Founded in 1926, Harrogate-based Adler & Allan provides environmental risk reduction services, supporting organizations in managing, improving, maintaining, and upgrading their critical infrastructure across the entire asset lifecycle across…

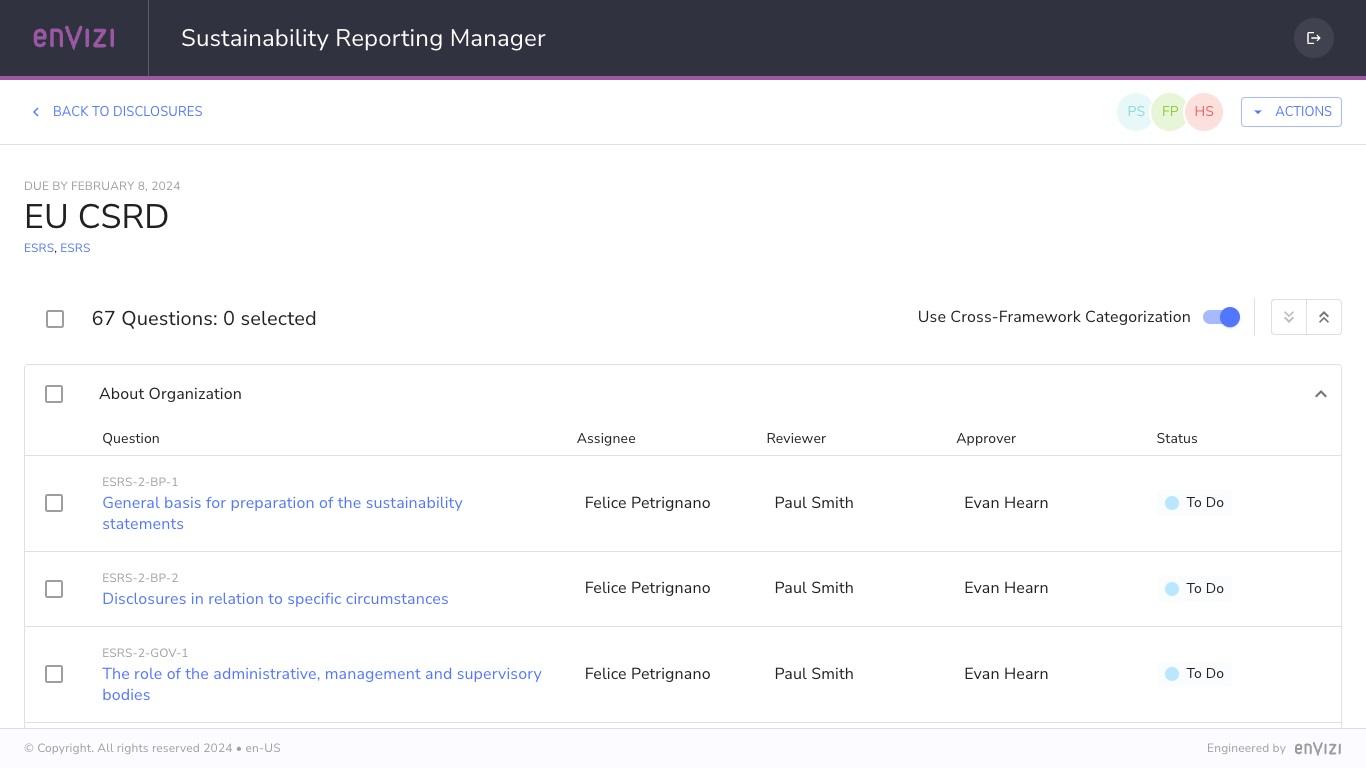

IBM Adds CSRD Sustainability Reporting Capabilities to ESG Data Platform

IBM announced that it has expanded the capabilities of its ESG data collection, analysis and reporting platform IBM Envizi, with features in the platform’s ESG Reporting Frameworks module aimed at helping organizations meet the reporting requirements of the EU’s Corporate Sustainability Reporting Directive (CSRD). The CSRD, which began applying to some companies as of the beginning of 2024, will significantly expand…

ISSB Publishes Digital Taxonomy for Sustainability Disclosures

The IFRS Foundation’s International Sustainability Standards Board (ISSB) announced the publication of the IFRS Sustainability Disclosure Taxonomy (ISSB Taxonomy), a new digital tool aimed at enabling investors to analyze sustainability-related financial disclosures based on the ISSB’s recently released sustainability and climate-related reporting standards. According to an IFRS statement announcing the new tool, the new Taxonomy “will enable investors to search,…

Guest Post: Companies Remain Largely Unprepared for Heightened Climate Risk

Physical climate risks are on the rise. However, progress on adaptation still varies, leaving some financial and non-financial corporates vulnerable. Paul Munday, Director and Global Climate Adaptation and Resilience Specialist at S&P Global Ratings, explains Extreme weather events and chronic physical climate risks are worsening globally. If mitigation efforts are not stepped up, by 2030, the number of climate-related disasters…

83% of Companies Say Collecting Accurate Data for CSRD Reporting Requirements will be a Challenge: Workiva Survey

More than 4 out of 5 professionals involved in corporate reporting say that collecting accurate data to comply with the EU’s Corporate Sustainability Reporting Directive (CSRD) will be a challenge, yet most companies plan to align their reporting with the new regulation, even if they don’t need to, according to a new survey released by business data and reporting solutions…