Investors call for greater clarity and certainty on regulatory expectations around sustainable finance disclosures. Convergence of ESG fund rules is still some way off, according to leading regulators, disappointing the hopes of asset managers and clients for alignment that would reduce costs and complexity. Speaking at the UK Investment Association’s (IA) Sustainability and Responsible investment Conference, regulatory experts said major…

Investors Urged to Stand up to ExxonMobil

Shareholders argue the company’s aggressive legal action undermines shareholder rights and the US SEC’s authority. Tensions are rising between oil and gas major ExxonMobil and its climate-focused shareholders, as investors push back against the company’s intimidation tactics. Exxon filed a lawsuit in January against investment manager Arjuna Capital and activist group Follow This in response to their shareholder proposal, which…

EU Parliament Approves New Law to Boost Manufacturing of Key Decarbonization Technologies

Lawmakers in the European Parliament voted 361 – 121 to approve the Net-Zero industry Act (NZIA), a new law aimed at supporting EU manufacturing of key technologies needed to achieve Europe’s climate and energy goals. The NZIA was initially proposed by the European Commission in March 2023, forming one of the key elements of its Green Deal Industrial Plan strategy…

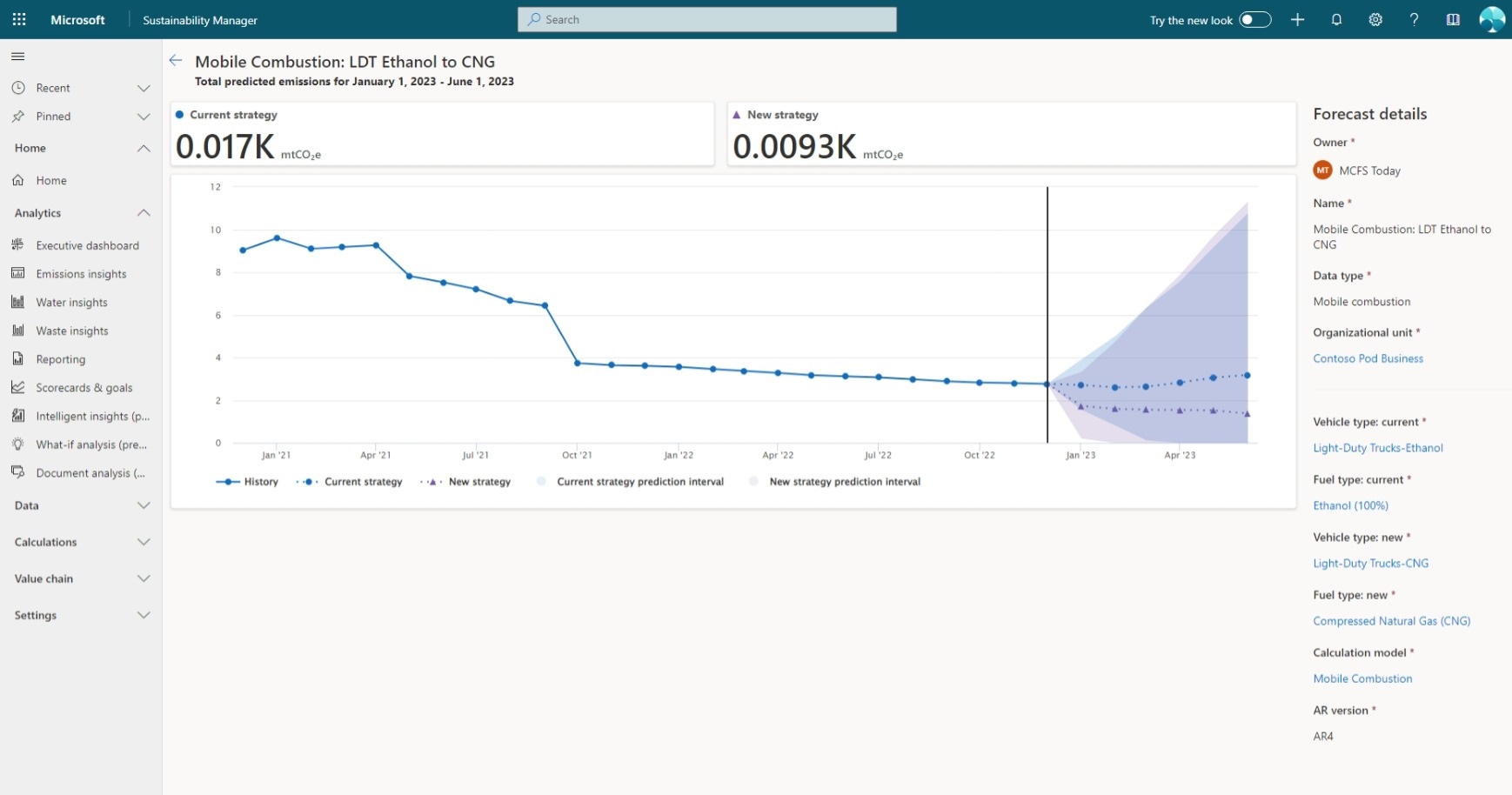

Microsoft Adds AI-Powered Capabilities to Predict Emissions Impact of Actions to Sustainability Platform

Microsoft announced the addition of a series of new capabilities and features to its sustainability solution, Microsoft Sustainability Manager, including tools to enable users to determine the emissions impact of business decisions, analyze and extract data from ESG-related documents, and assess scenarios for water and waste management. Sustainability Manager forms part of Microsoft’s Cloud for Sustainability platform. Microsoft unveiled the…

Take Five: Parallel Priorities

A selection of the major stories impacting ESG investors, in five easy pieces. People and planet have been put on an equal footing by standards setters. Capital investments – The International Sustainability Standards Board (ISSB) finally confirmed its next move, having completed much of the heavy lifting on its standards for climate and general sustainability disclosures. Following an extensive consultation…

From Ambition to Action

Storebrand Head of Climate and Environment Emine Isciel stresses the need for governments to take effective measures to implement the Global Biodiversity Framework, specifically on the alignment of financial flows. As countries begin the countdown to the 16th UN Biodiversity Conference of the Parties (COP16) in Colombia later this year, the pressure is mounting on governments to develop ambitious – and…

Canada to Require Plastic Producers to Track, Report on Plastics Placed on Market

The Canadian Government announced the launch of a new Federal Plastics Registry requiring plastic producers to report on the quantity and type of plastic they place on the Canadian market, and tracking plastic across its lifecycle in the economy, from production through end of life. According to the government’s statement announcing the launch, the new registry supports Canada’s zero plastic…

Corporates Neglect Water Risks

Nature-focused scenario mapping and valuation are deemed pivotal to managing water stress as global warming worsens. Most companies globally are still failing to account for water-related risks in their business operations and supply chains, industry experts warned during Rathbones Greenbank’s 27th Investor Day. “Last year, we saw the first year of 1.5°C warming, and that is having a flywheel effect…

Think Laterally to Halt Care Sector Exploitation

Dame Sara Thornton, Consultant on Modern Slavery at CCLA IM and former Independent Anti-Slavery Commissioner, says investors can help to protect workers. Over the last year there has been growing evidence of exploitation in the UK care sector. Unscrupulous opportunists here and overseas have exploited the desire of workers to obtain social care visas and have either abandoned them in…

Beyond a Governance-led Approach to Stewardship

Jessye Waxman, Senior Campaign Strategist at Sierra Club, argues that investors are failing to adapt to a new era of risk ahead of the 2024 AGM season. April marks the start of AGM season, the time of year when global investors are preparing to vote on critical matters at companies in their portfolios that have a significant impact on the climate….