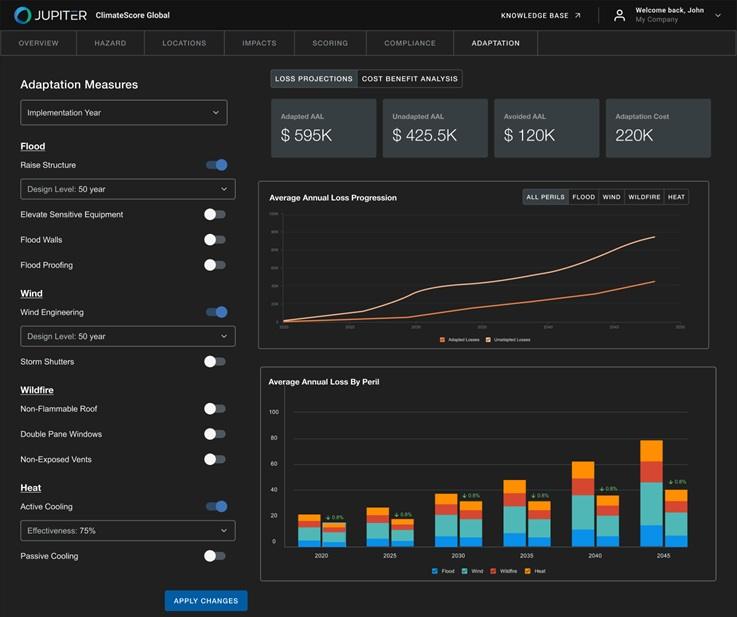

Climate data solutions provider Jupiter Intelligence announced the launch of a series of new tools, aimed at enabling banks and asset managers to quantify physical climate risk within their portfolios and to calculate the ROI on resilience investments. The new tools will form part of Jupiter Intelligence’s flagship ClimateScore Global climate analytics platform. Launched in 2020, the platform was designed…