Local government pension schemes (LGPS), which manage nearly £400bn in long-term capital, have the potential to become key drivers of sustainable transformation, benefitting communities and driving progress towards environmental goals. Since 2015, pension reforms have continued to consolidate LGPS into fewer larger pools, with the ambition of improving cost efficiency and collaboration. While this should ultimately unlock positive synergies for…

Sustainability Compliance Solutions Provider osapiens Invests $40 Million to Enter UK Market

Sustainability software provider osapiens announced an expansion into the UK market, with plans to invest €35 million and creating more than 150 sustainability roles to help firms meet compliance requirements. Founded in 2018, Mannheim, Germany-based osapiens provides cloud-based software solutions aimed at enabling organizations to automate complex compliance tasks, streamline operations, and monitor sustainability metrics in real time, and to…

Wise Moves: Why UK Companies Are Looking West for IPOs – and What ESG Has to Do With It

In 2021, fintech unicorn Wise made headlines when it chose to go public on the London Stock Exchange (LSE) through a direct listing — a vote of confidence in the UK capital markets. Fast-forward to 2025, and the company is now considering a switch to the US, joining a wave of UK firms drawn to the deeper pools of capital…

Wise Moves: Why UK Companies Are Looking West for IPOs – and What ESG Has to Do With It

In 2021, fintech unicorn Wise made headlines when it chose to go public on the London Stock Exchange (LSE) through a direct listing — a vote of confidence in the UK capital markets. Fast-forward to 2025, and the company is now considering a switch to the US, joining a wave of UK firms drawn to the deeper pools of capital…

Wise Moves: Why UK Companies Are Looking West for IPOs – and What ESG Has to Do With It

In 2021, fintech unicorn Wise made headlines when it chose to go public on the London Stock Exchange (LSE) through a direct listing — a vote of confidence in the UK capital markets. Fast-forward to 2025, and the company is now considering a switch to the US, joining a wave of UK firms drawn to the deeper pools of capital…

Wise Moves: Why UK Companies Are Looking West for IPOs – and What ESG Has to Do With It

In 2021, fintech unicorn Wise made headlines when it chose to go public on the London Stock Exchange (LSE) through a direct listing — a vote of confidence in the UK capital markets. Fast-forward to 2025, and the company is now considering a switch to the US, joining a wave of UK firms drawn to the deeper pools of capital…

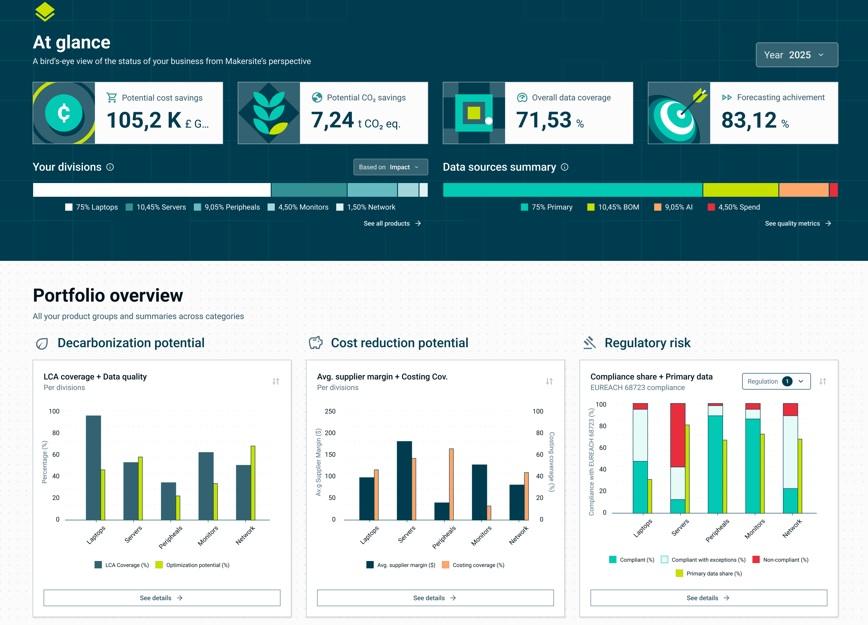

Makersite Raises $70 Million to Help Manufacturers Design More Sustainable Products

Supply chain data company Makersite announced that it has raised €60 million (USD$70 million) in a series B financing round, with proceeds aimed at enhancing its platform enabling manufacturers to make greener, safer and more affordable products. Founded in 2018, Stuttgart, Germany-based Makersite provides Product Lifecycle Intelligence solutions aimed at enabling manufacturers to gain a deeper understanding of what is…

SBTi Releases Net Zero Standard for Banks, Investors

The Science Based Targets initiative (SBTi), one of the key organizations focused on aligning corporate environmental sustainability action with the global goals of limiting climate change, announced the release of its finalized Financial Institutions Net-Zero (FINZ) Standard, aimed at enabling banks and investors to set net zero-aligned targets for their lending, investing, insurance and capital markets activities. Among the key…

UK to Allow Use of Carbon Removals in Emissions Trading System

The UK government’s Emissions Trading Scheme Authority announced that it has decided to integrate greenhouse gas removals (GGRs) into its Emissions Trading Scheme (ETS), allowing the use of carbon removals for companies to address hard-to-abate emissions to meet their allowances under the industrial GHG emissions reduction system. Launched in 2021 to replace the UK’s participation in the EU’s Emissions Trading…

Redwheel closes climate engagement fund

Redwheel has confirmed its decision to close its Global Climate Engagement fund due to a lack of investor demand. The product was brought to market in 2024 under the management of John Teahan (pictured), and currently has $0.8m in assets under management (AUM), according to the group. The Article 8 fund was also supported by the firm’s sustainability research arm, Greenwheel, and…