Florida axes BlackRock, but what about their other external managers?

End of Week Notes

They are UN-PRI signatories, too

More absurdity coming out of Florida this week, as the state’s Chief Financial Officer Jimmy Patronis announced the state treasury will pull about $1.43 billion in long-term fixed-income securities and $600 million in overnight cash investments managed by BlackRock because of the firm’s commitment to sustainable investing. It’s all part of Republican efforts to discredit and demonize the asset management industry’s commitment to assessing climate change and other material ESG-related risks and opportunities.

“I need partners within the financial services industry who are as committed to the bottom line as we are — and I don’t trust BlackRock’s ability to deliver”, Patronis said.

Just to be clear, Florida’s elected Chief Financial Officer, a Republican who runs a restaurant, doesn’t believe the world’s largest asset manager, which generates nearly $20 billion in annual revenue, is as committed to the “bottom line” as he is.

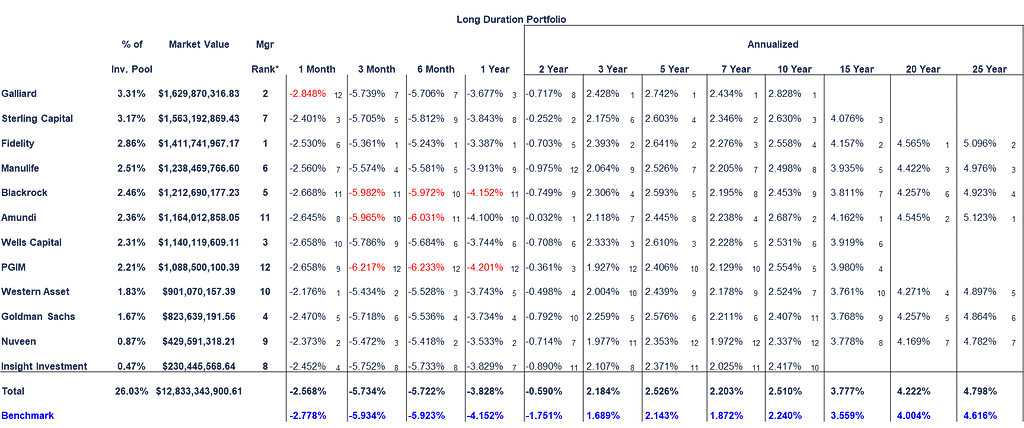

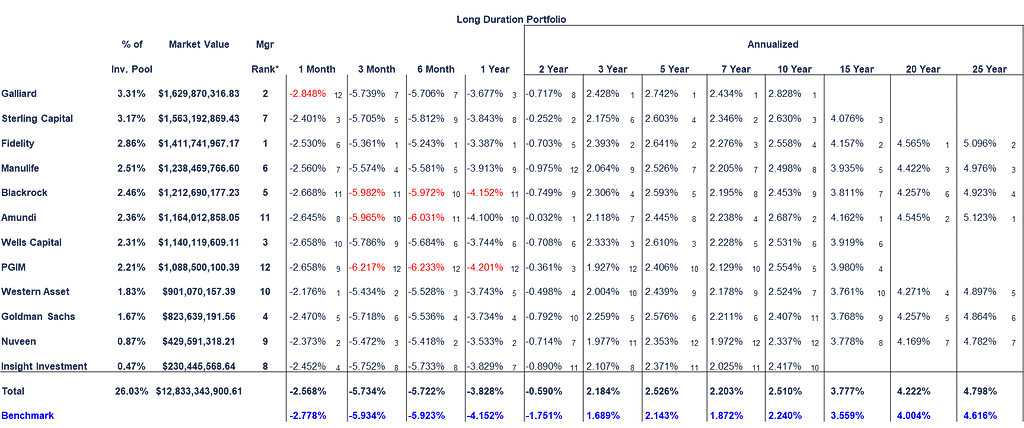

Let’s take a quick look at BlackRock’s “ability to deliver” bottom-line returns to see if there is any rational basis for Patronis’ concerns. To do this I looked at the publicly available returns of the Florida Long Duration Portfolio as of March 2022, the most-recent information on it I could find.

Patronis’ office employs a dozen external managers to run the portfolio. The table above shows BlackRock’s “Manager Rank”, calculated by Patronis’ office, as fifth of the 12. That’s in the top half, based on 1, 3, and 5 year risk-adjusted rankings of annualized returns. Based on these “bottom line” results, it is hard to imagine how a fiduciary could say with a straight face that he doesn’t “trust BlackRock’s ability to deliver”, unless that person has some other agenda.

The Republican playbook is to single out BlackRock. Yet, as reported by Pensions & Investments, 10 of the 11 other external managers for the Long Duration Portfolio are also signatories to the UN Principles for Responsible Investing. The very first of those principles is: “We will incorporate ESG issues into investment analysis and decision-making processes.”

As Florida’s Chief Financial Officer, Patronis has a fiduciary duty to exercise prudence and loyalty in his decision-making. This requires that investment decisions be made on a reasonable basis taking into account material risks and opportunities. Singling out BlackRock for something nearly all of the fund’s other managers also do because they have similarly concluded these matters are material is hardly a model of prudent decision-making. Neither is ignoring BlackRock’s actual financial performance, which is in the top half among the 12 managers. Neither is the broader claim being made by Patronis that climate change is not a material risk and therefore must be ignored. In Florida, no less.

But wait, you mean BlackRock is not boycotting fossil fuel?

Part of the broader Republican anti-ESG narrative is that “ESG” is out to destroy the fossil-fuel industry. The claim is that BlackRock and other asset managers are “boycotting” fossil fuel. While many investors are divesting from and avoiding fossil fuel, BlackRock and most other large asset managers and banks that have been singled out by Republicans as doing so are currently investors in fossil fuel and fully intend to continue on that path.

For more on that:

Morningstar’s Don Phillips has a unique take on the Right’s anti-ESG stance:

It was only a matter of time until the tidal wave of concern over environmental, social, and governance investing triggered a backlash, but it has surely come with a vengeance. Notably, however, the revolt hasn’t come primarily from business interests angered about being asked to alter their practices. The business community in many cases has embraced ESG, recognizing the importance attached to these concerns by the communities they serve and the young talent they want to attract to their businesses.

Phillips argues that politicians dividing asset managers into red and blue sides risks undermining the scale advantage that made America the global leader in asset management “and specifically in asset management for the middle class, as represented by mutual funds”.

That the undermining of this competitive business advantage comes from supposedly pro-business and pro-middle-class Republicans is an irony that seems to be lost on these politicians. The ability of local politicians to damage the American investment landscape for their own short-term political advantage should not be ignored.

Will Anti-ESG Forces Undermine What Made American Mutual Funds Great?

Follow me on Twitter @Jon_F_Hale

Florida axes BlackRock, but what about their other external managers? was originally published in The ESG Advisor on Medium, where people are continuing the conversation by highlighting and responding to this story.