Investing in Water May Be Appealing, But Investors Have Few Compelling Choices

Sustainability Matters

Here are some water stocks and water funds to consider

The case for investing in water is driven by the challenge of providing enough freshwater to meet growing demand against the backdrop of climate change. Global population growth along with improving living standards in developing countries are increasing demand for clean drinking water and for the use of water in agriculture and manufacturing.

Meeting growing demand requires a reliable and growing supply of freshwater. But much of the world’s existing water infrastructure is aging and in need of replacement or modernization. Looming above all is climate change, which poses a threat to freshwater supply. Extreme weather events are already affecting the reliable availability of water. And longer-term changes in temperature and precipitation patterns will lead to reduced amounts of freshwater in many parts of the world.

From a thematic investment perspective, the supply/demand dynamics of water create opportunities for investments in utilities, infrastructure, and technology that increase the supply of safe freshwater and the reliability of that supply.

From a sustainability perspective, investments in water contribute to resource security and basic needs, two key impact themes identified by Morningstar Sustainalytics. Similarly, investments in water contribute to several of the United Nations Sustainable Development Goals, including SDG #6 Clean Water and Sanitation; SDG #11 Cities and Communities; and SDG #12 Responsible Consumption and Production.

I found a number of potential stocks and funds for investors to consider, but they all come with caveats. Keep reading to learn more.

Investing in Water Stocks

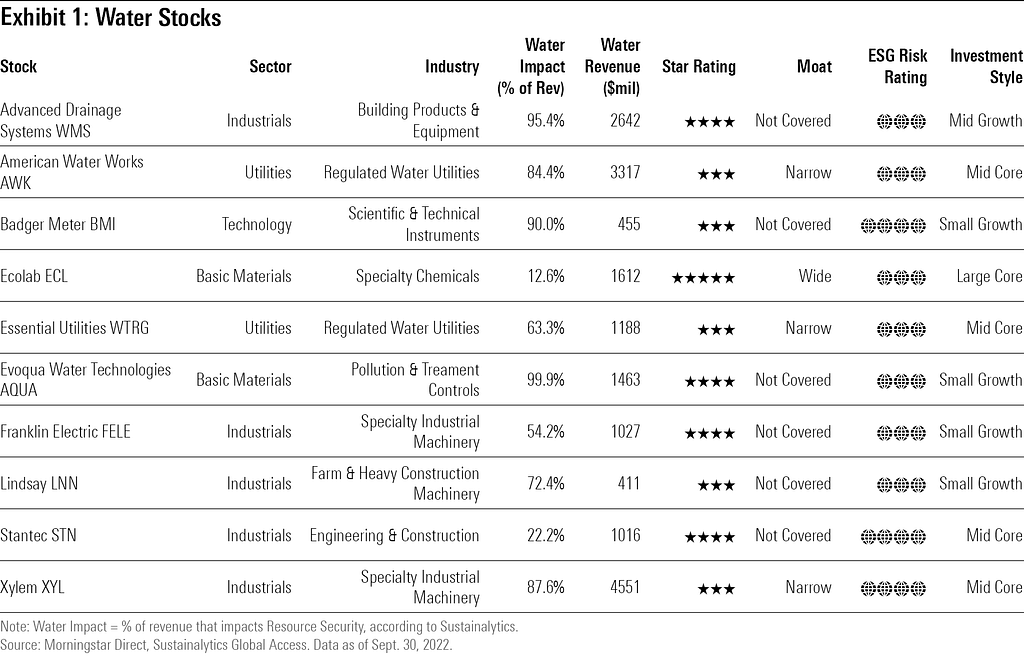

Investors interested in water stocks can begin with the list in Exhibit 1. Based on revenue connected to their water-related products and services, these stocks all contribute to the impact themes and Sustainable Development Goals listed above, with a primary emphasis on resource security and clean water and sanitation. They are also among the most widely held stocks of water-themed funds.

Most of the water stocks on the list are pure plays. Five of them derive virtually all of their revenue from water-related activities: Advanced Drainage Systems WMS, American Water Works AWK, Badger Meter BMI, Evoqua Water Technologies AQUA, and Xylem XYL.

Ecolab ECL is an exception, as it is primarily involved in the cleaning and sanitation industry, deriving only an estimated 12.6% of its revenue from its activities treating wastewater and reducing water usage. As the largest company on the list, though, Ecolab’s water-related revenue ranks fourth out of the 10. Moreover, Morningstar strategist Seth Goldstein expects Ecolab’s industrial water business to be its largest source of incremental profit growth in the future. The stock, which has a Morningstar Economic Moat Rating of wide, currently has a Morningstar Rating of 5 stars, indicating that it’s trading below its estimated fair value.

Morningstar covers three other water stocks on the list, and all have narrow moats and are currently fairly valued (3 stars). American Water Works and Essential Utilities WTRG are both regulated water utilities, while Xylem is one of the leading water technology companies in the world. Morningstar analyst Krzysztof Smalec expects Xylem to widen its economic moat because its solutions help utilities detect leaks and operate more efficiently.

Investing in Water Funds

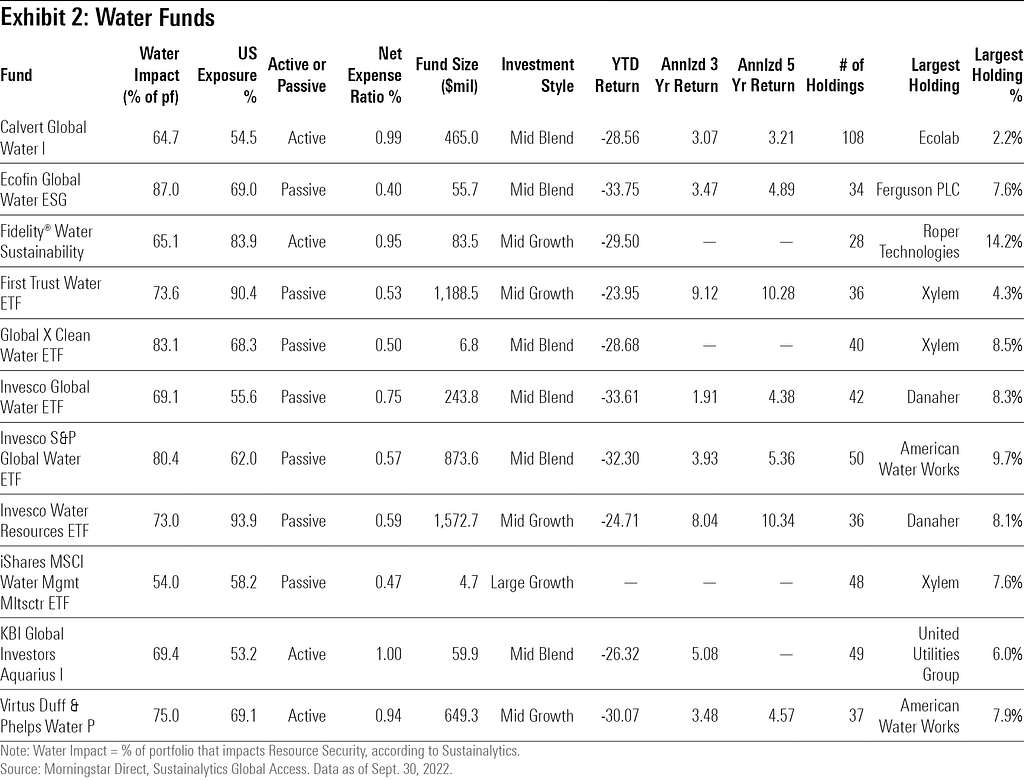

People interested in investing in water funds have roughly 90 open-end and exchange-traded funds globally from which to choose, but U.S. investors can select from only the 11 funds listed in Exhibit 2.

Investors can choose U.S.-focused or global portfolios, managed either actively or passively. Unfortunately, there are few standouts on the list.

The two largest funds, Invesco Water Resources ETF PHO and First Trust Water ETF FIW, are both U.S.-focused ETFs that track different indexes. Their nearly identical 10.3% five-year annualized returns outperform those of the S&P 500, although they have lost more than the broad equity index this year. (Note that star ratings are irrelevant for evaluating these funds’ past performances because they all reside in the natural resources Morningstar Category, which includes funds investing in many other areas like energy, chemicals, paper, mining, steel, and agriculture.)

The Largest Water Funds Are Expensive

Beyond that, they aren’t cheap, both charging more than 0.50% for concentrated indexed portfolios with fewer than 40 positions. That may be close to the going rate for thematic index ETFs, but with more than $1 billion in assets each, both should be cheaper.

PHO devotes a whopping 8.1% of assets to its largest holding, Danaher DHR, which only derives about 11% of its revenue from water-related activities that contribute to resource security, according to Morningstar Sustainalytics’ impact metrics. That 11% of revenue does represent about $2.4 billion, more than that of most of the pure water plays. Unlike Ecolab, though, Danaher’s water-related activities are not expected to be a major growth catalyst for the company.

PHO’s number-two holding isn’t much of a water play, either. Waters Corporation WAT, which takes up another 7.8% of PHO’s assets, certainly sounds like it could have something to do with water. But Waters’ primary business is quality assurance tools used in the production of pharmaceuticals. These tools can be used to test water quality; however, Morningstar senior analyst Julia Utterback estimates less than 7% of Waters’ revenue is associated with water, and Morningstar Sustainalytics assesses that the firm has no impact on water-related sustainability themes. That’s more than 15% of PHO’s assets tied up in two holdings that are not even close to being pure plays on water. Advantage to FIW, which doesn’t hold Waters and is a little cheaper. FIW does hold Danaher, however, but at 4%, its position size is half that of PHO’s.

Among the global water funds, Ecofin Global Water ESG EBLU is the most reasonably priced on the entire list at 0.40%. The fund is a 34-name global portfolio based on an index created by Ecofin, an asset manager focused on sustainability, climate, and environmental investments. All of the holdings in this open-end fund are companies with at least half of revenue derived from water. That means no Danaher or Waters, although the fund holds Ecolab, taking a more expansive view of Ecolab’s water revenue than Morningstar Sustainalytics. The fund also has a sustainability screen, requiring holdings to have Sustainalytics ESG Risk Ratings of Medium or lower. The fund has been around for more than five years but has an asset base of only $56 million. While it has persisted for that long with a small asset base, this raises at least a caution flag as small funds carry a risk of shutting down.

An alternative for global water exposure is the $874 million Invesco S&P Global Water ETF CGW, which follows the S&P Global Water Index of the 50 global water companies. It doesn’t hold Danaher, Ecolab, or Waters. Still, it’s overly expensive at 0.57%.

Water Exposure in Sustainable Funds

Fund investors can also look elsewhere for exposure to water. Many more broadly based sustainable funds include water stocks. Take a look at sustainable infrastructure funds, environmental services funds, or diversified sustainable funds in the mid-cap blend or mid-cap growth categories or the global small/mid-stock category.

This article originally appeared at Morningstar.com.

Follow me on Twitter @Jon_F_Hale

Investing in Water May Be Appealing, But Investors Have Few Compelling Choices was originally published in The ESG Advisor on Medium, where people are continuing the conversation by highlighting and responding to this story.