Proxy season 2025: Pay pushback, AI oversight and ESG retreat

The 2025 proxy season revealed a decisive shift in shareholder priorities. While the volume and support for environmental and social proposals declined, investors turned their attention to board accountability, pay alignment, and a new frontier: AI governance.

See also: What AI really means for asset management: How firms can prepare

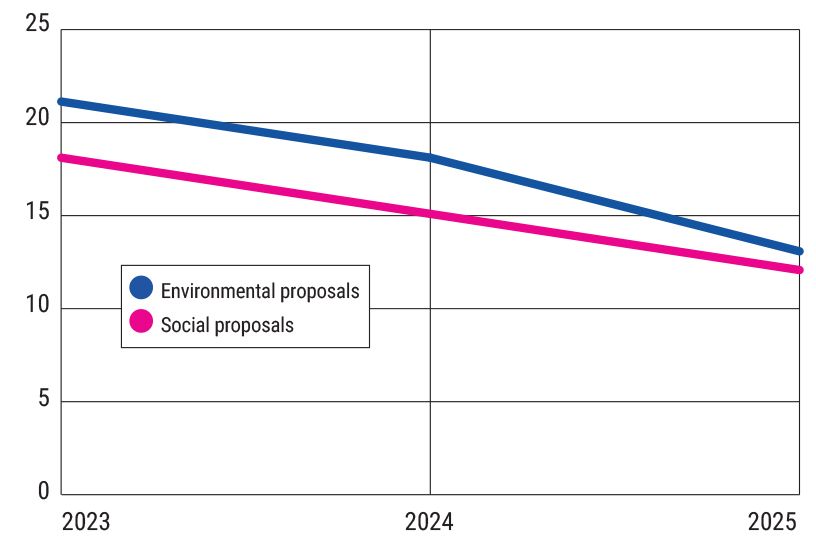

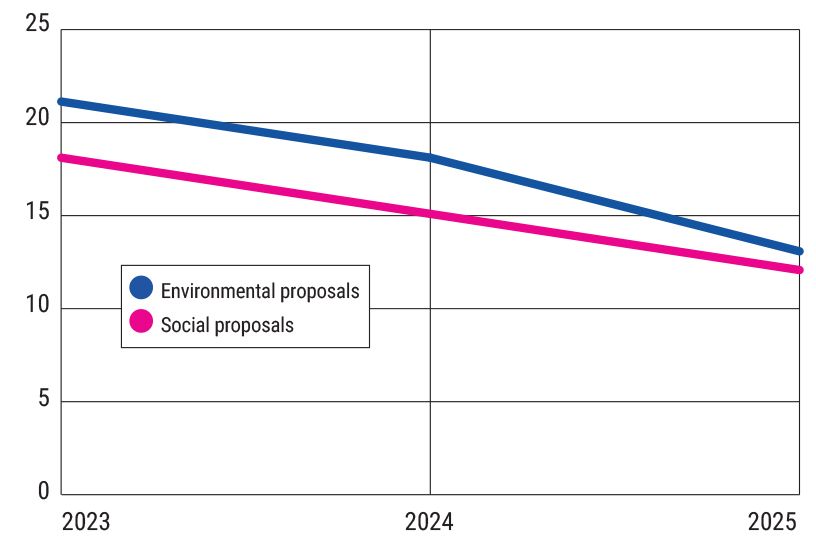

In the US, shareholder proposals dropped by around one-third. Just 13% of environmental proposals and 12% of social proposals gained significant support, falling from previous years as seen in the graph below. The sharp fall was driven by the US Securities and Exchange Commission’s new guidance which was introduced at the beginning of the year, giving companies more leeway to exclude ESG proposals from ballots.

E&S shareholder proposals gaining significant support

Meanwhile, proxy advisors ISS and Glass Lewis scaled back support for ESG resolutions, citing better corporate disclosure and mounting political pressure. Large asset managers including BlackRock and Vanguard also retreated from blanket diversity mandates, while rolling out client-directed voting policies to manage reputational risk in a polarised landscape.

Despite this cooling, several resolutions made waves. First Solar committed to avoiding deep-sea mining following shareholder engagement. Shell faced growing climate scrutiny, with over 20% of shareholders voting against its LNG strategy. And Drax was forced to abandon its AGM after protests over biomass sustainability and environmental justice.

Emerging trends

Among leading UK-listed companies, there has been a clear move towards US style executive remuneration. US CEOs earn substantially more than UK CEOs, where median figures sit at more than $16m, compared to $6.5m this side of the pond. Backed by ISS and Glass Lewis, major UK banks NatWest, Barclays and HSBC increased c-suite pay. However, at Centrica, 40% of investors voted against the CEO’s pay award as energy bill players struggled with record levels of debt, highlighting tensions between executive compensation and workforce fairness.

Artificial intelligence entered the proxy spotlight this year. Investors filed proposals calling for more care over the data used to train AI, disclosures on discrimination from generative AI, and board-level oversight of AI risks. In fact, last year 20% of S&P 500 companies had at least one director with AI expertise. Tech giants Alphabet, Amazon, Apple and Meta all received proposals requesting disclosures on the risks of the improper use of external data in AI development, which received an average support of 11%. This marks the start of what many expect to be a defining governance issue in years to come.

The rise of anti-ESG and anti-DEI proposals also characterised the season, with filings from conservative groups like the National Center for Public Policy Research and the National Legal and Policy Center. These proposals gained little traction, averaging just 1.4% support, but underscored the extent of political pushback in the US.