Right time, right place: Why now is the moment for British pension funds to invest in Britain

We need a new political economic model for the UK.

Urban and regional economic development theory and policy pre-dates the rise of institutional investment and investors in the 1980s and 1990s.

So, we need to develop new theory and policy, fit-for-purpose economic and regional growth models that properly reflect this fundamental change in our financial landscape.

If we can do this – turning more and more financial investment into economic investment as we go – then we can shift the course of financialisation, and get institutional investors off the sidelines and onto the football pitch where we’re 5-0 down at half-time in the Inclusive Growth Cup Final.

See also: Building back local with place-based impact investing

‘Invest in Britain’

Britain has seen decades of underinvestment, entrenched regional and social inequalities, and fresh pressures from geopolitical and economic uncertainty.

To change course, as it must, the UK needs a long-term social infrastructure covering housing, health and education and other foundational economy sectors including transport and communications, clean energy and utilities and basic human services like libraries and community centres.

Public funding alone cannot generate the investment required to meet the UK government’s policy ambitions; unlocking institutional capital is essential to complement public resource.

As such, it’s time for a historical shift from ‘made in Britain’ to ‘invest in Britain’.

Too much of our investment, and our pension fund money, is being sent overseas – it’s time to bring it home, and fly the flag for the right reasons.

And yet, conversely – or perversely – foreign pension funds already invest in Britain, snapping up key infrastructure assets and companies to boot.

Right place, right time

But there is a way forward.

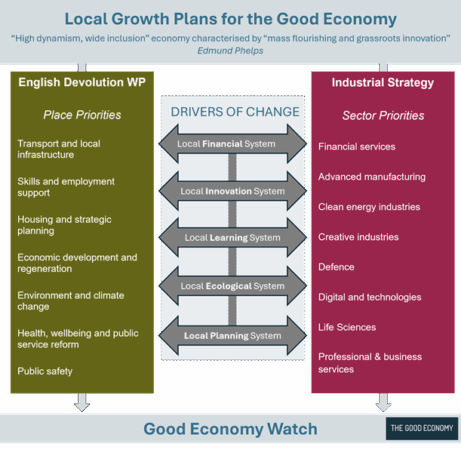

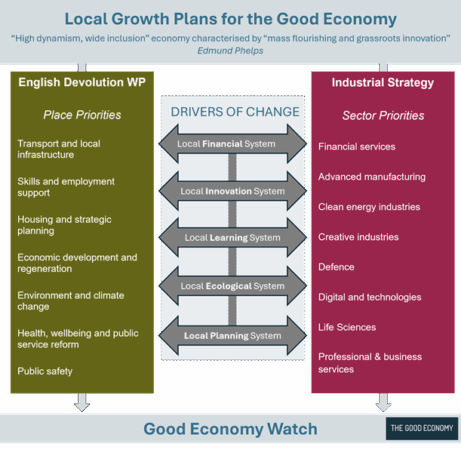

Quite simply, the UK economy needs to stand on ‘two legs’: A National Industrial Strategy and A National Social Infrastructure Strategy. Place-based economic development – my preferred approach to national renewal – would involve forging policy linkages between these Strategies at the national, regional and local levels.

The UK government’s 2025 pension reforms have challenged the local government pension scheme (LGPS) to develop local investing strategies.

The UK’s pension reform agenda sits within a broader reform programme that includes devolution, local government reform, housing and planning, infrastructure investment and a new industrial strategy.

All of these policies encourage a place-based, decentralised approach – less government control, more power to local people.

With nearly £400bn of assets today and projected to reach £1tn by 2040, the LGPS has the potential to be a cornerstone of the national effort to close the investment gap, and build a more resilient, inclusive domestic economy.

Place-based investing is exactly what all our political parties should be getting behind – using pensions to invest responsibly and long-term in affordable housing, regeneration, SME finance, to create local jobs and sustainable infrastructure to support the local / regional energy transition.

It’s neither ‘woke’ nor rapacious – this is local investing, for local places.

Leading by example

Only a small fraction of UK pension money is invested domestically in ways that support inclusive, sustainable development.

However, pioneering funds and pools are demonstrating what’s possible — investing in affordable housing, clean energy, SME finance and regeneration – highlighting the potential for wider adoption, and showing what is possible in terms of investing locally in ways that deliver financial returns and place-based impact – see case studies here

Private markets already play a central role in LGPS investment – real estate, infrastructure, private credit and private equity are particularly well-suited to long-term liabilities and capital stability. Local investment will largely be done via private markets – both intermediated and direct investments.

By working collectively, the LGPS can build confidence among members and stakeholders while demonstrating the long-term value created by local investing – setting a new benchmark for transparency in private markets.

The upshot is that place based investing is actually possible – and recent local investing white paper produced by The Good Economy, and backed by a broad coalition of sponsors and supporters drawn from the LGPS sector, specialised private markets fund managers, local and central government, trade bodies and a pan-regional partnership is about how to make it happen.

As devolution gathers pace across England, strategic authorities and others need to do their bit too on the demand side. The elephant in the room is the big capacity and capability gap everywhere – which is why there is an imperative to work together and learn from others.

See also: Place-based investing: Think sustainably, act locally

Economic growth, social fabric

For me, the focus isn’t only on economic growth, but also on the social fabric that underpins it. Place-based impact investment is about more than money flows—it’s about supporting the networks, institutions, and relationships that give communities resilience and vitality.

Collaboration sits at the heart of it all.

This is about a new public-private investment partnership built on good governance, innovative financial models, alignment around delivering better outcomes, fair sharing of risk and rewards, and transparent financial and impact performance reporting. And lessons must be learnt from the private finance initiative (PFI) experience, where some investments led to high, long-term financing costs and poor-quality infrastructure contributing to negative rather than positive social outcomes.

Local investing now has the appropriate level of action planning in it, and enough stakeholder support behind it, to get the ball rolling on building the New Local Financial Systems needed to fuel the country’s cornerstone Local Growth Plans.

The leitmotiv or golden thread running through the new wave of Local Growth Plans should be “Made in Britain, Invest in Britain, Buy British”.

The government’s official guidance refers to the plans as “cornerstones” and “guiding stars”.

But what we really need from the plans – in these times of prolonged heightened geopolitical uncertainty – is for them to act as ‘bulwarks’ and ‘sea walls’ that give us all the space and time needed to build a resilient and nationwide good domestic economy.

In today’s polarising political climate, cross-party support isn’t easy to come by – but if we truly want to see better outcomes for communities across the country, local investing offers a way forward.