SEC Chair: Investors Want Supply Chain Emissions Reporting to Manage Transition Risk

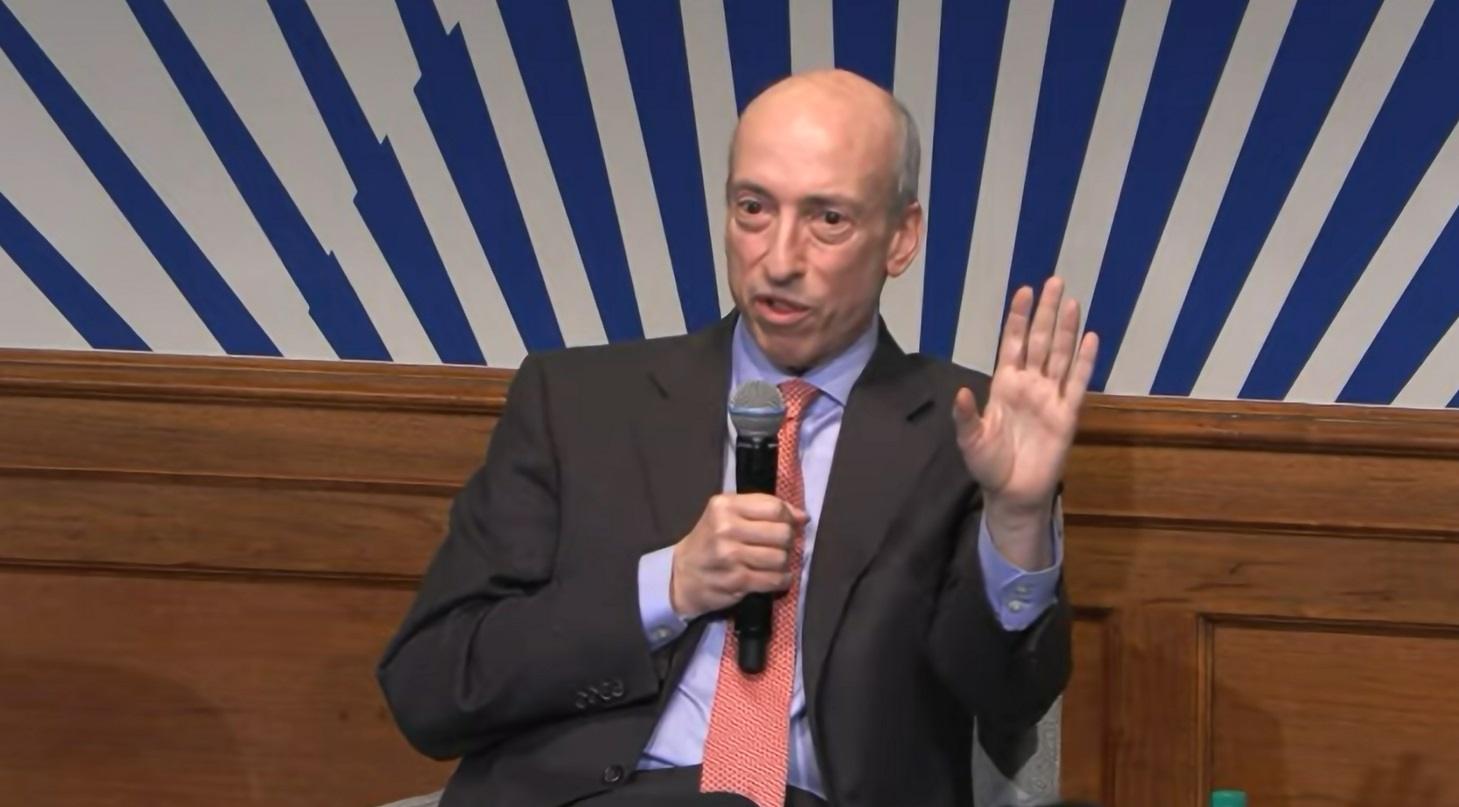

Investors are backing the U.S. Securities and Exchange Commission’s (SEC) proposal for Scope 3 value chain emissions reporting from companies, saying that it provides them with key information to assess company risk, according to SEC Chair Gary Gensler’s comments in a forum discussion at the U.S. Chamber of Commerce.

The comments suggest that Scope 3 emissions reporting will likely remain a part of the finalized rule when it is eventually released, although the final formulation of the supply chain emissions reporting requirements remains unclear, with companies and smaller enterprises pushing back on issues including the cost and disruption from complying with the new rules, and Gensler’s own expressed concerns about staying within the SEC’s mandate.

The SEC released its proposed climate disclosure rules in March 2022, which would require U.S. companies to provide information on climate risks facing their businesses, and plans to address those risks, along with metrics detailing the companies’ operational climate footprint, and in some cases emissions emanating across their value chains.

In his remarks, Gensler stressed that the key motivation behind the SEC’s rulemaking was to fulfil its remit to help “investors making investment decisions,” with the climate reporting rules aimed at providing investors with material information in an environment in which companies are already increasingly making climate-related disclosures.

Gensler said:

“In 2021 of the companies listed in the Russell 1000, so roughly those top thousand companies, 81% already make some climate risk disclosures and 57% to Scope 1 and Scope 2 disclosures – probably grown in 2022, far less one so called Scope 3. Now there’s not consistency, there’s not necessarily comparability there and there’s a role for the SEC to try to bring some consistency and comparability. And that drives efficiency in capital markets because then investors get something consistent.”

Gensler said that the SEC’s proposed climate rule has received significant feedback, including 16,000 comments from companies, investors and other stakeholders, with the rules’ emissions reporting requirements as a key focus area, with “a lot of comments on the Scope 3 reports.” While noting that investors were broadly supportive of Scope 1 and 2 emissions reporting and split on Scope 3, issuers had “a lot of questions, doubts and concerns” on the Scope 3 reporting requirements.

In order to address issuer concerns, Gensler noted the SEC’s tiered approach to its Scope 3 reporting requirements, conceding that “Scope 3 isn’t as well-developed yet,” and requiring the disclosure only if the company determines that it is material or has made a public commitment regarding its Scope 3 emissions.

In addition to the issuers’ concerns, Gensler said that the SEC received comments from smaller enterprises and agricultural entities concerned that they would be required to provide emissions reporting to their larger-company customers, despite not being under the remit of the SEC.

Gensler said:

“We’ve got a lot of comments from the agricultural Community the you know rural America that said, ‘look we’re a farmer or rancher that you know we’re not a public company we shouldn’t get caught up in this.’ And I agree with that.”

The SEC chair added that these are the issues that the commission is currently working on for its final rule:

“That’s why staff’s looking through as to how we can ensure that we don’t indirectly sort of do what we can’t do directly – we don’t regulate non-public companies no and we’ve been very clear on that.”

Despite the Scope 3 challenges, however, Gensler was clear that the issue remained important to investors in order for them to manage risk:

“What investors have told us in the comments that they’ve sent us is that understanding the emissions of a company’s supply chain – and this is from investors – understanding the emissions of the supply chain helps understand what’s called transition risk, you know what might be the future for that business. And it might be transition risk because customers may buy different products because of the emissions of a supply chain, or regulations may change, or even employees may want to work for one firm versus another.

“The only remit we have at the SEC is through that – is it material?”

Whatever final form the SEC’s rule takes, however, many U.S. public companies will likely find themselves required to provide Scope 3 disclosures under other regulatory reporting regimes. California Governor Gavin Newsom, for example, recently signed a bill into law which will effectively require large U.S. companies that do business in the state to disclose their full value chain emissions. Similarly, the EU’s Corporate Sustainability Reporting Directive (CSRD) extends the reporting requirements to non-European companies that generate over €150 million in the EU, and also includes Scope 3 reporting. Gensler noted that the requirements imposed by these laws will affect the “economic baseline” of the cost of the SEC’s climate reporting rule, with many companies already required to report on these factors.

Gensler also did not indicate the timeline for the completion of the climate-related reporting rule. Gensler said that “I don’t know when it will be in the Federal Register,” jokingly adding “and I’m not announcing that here.”