SEC Chair Says Climate Disclosure Rule Feedback Pushes Back on Scope 3 Reporting as Less Developed, Unreliable

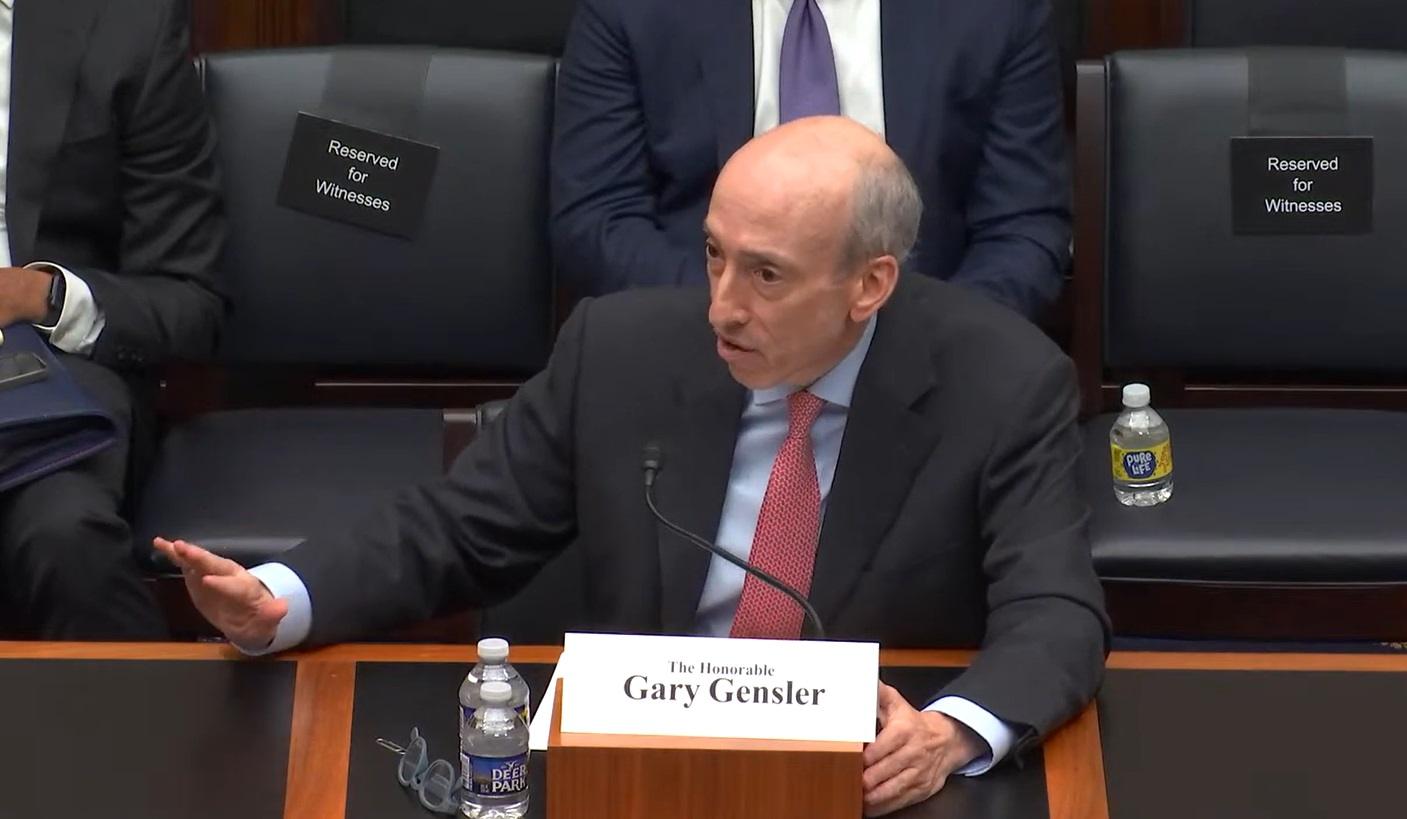

Many companies have raised concerns with the U.S. Securities and Exchange Commission’s (SEC) plans to include Scope 3 emissions – those originating in areas outside of a company’s control, including the supply chain – as part of the reporting requirements under the Commission’s upcoming climate disclosure rule, according to testimony given on Wednesday by SEC Chair Gary Gensler to the House Financial Services Committee.

According to the SEC Chair, issues included the early stage of development and current unreliability of Scope 3 reporting.

Gensler said:

“Though many companies know their own greenhouse gas emissions, they don’t necessarily know… their entire supply chain and fewer public companies are currently publishing that. We put out a proposal to bring consistency to the disclosure, but we heard a lot of comments coming in to say Scope 3 disclosure is not as well developed, there’s not as many companies putting it out, and its frankly not yet as reliable.”

Gensler said that the Commission would take these concerns into consideration in drafting the final rules.

The SEC Chair added that some comments raised concerns about the impact of the rules on smaller businesses, particularly farms and agricultural companies that would not technically be covered by the new rules, but would be pressured to gather and provide emissions data to their customers who are impacted.

Gensler said:

“We, the SEC, don’t regulate these companies, those non-public companies, so staff is looking very closely to ensure that we stay within our authorities. It’s about the public companies.”

The SEC released its proposed climate disclosure rules in March 2022, which would require U.S. companies to provide information on climate risks facing their businesses, and plans to address those risks, along with metrics detailing the companies’ operational climate footprint, and in some cases emissions emanating across their value chains.

Even if the SEC eases up on its supply chain emissions reporting requirements, however, many companies may find themselves required to provide Scope 3 details under other disclosure regimes. California Governor Gavin Newsom, for example, announced last week that he intends to sign new climate disclosure legislation into law which would require effectively require most large U.S. companies to disclose their full value chain emissions. Similarly, the EU’s Corporate Sustainability Reporting Directive (CSRD) extends the reporting requirements to non-European companies that generate over €150 million in the EU.

Commenting on the new California climate disclosure rules, Gensler said that if passed, they would effectively make the SEC’s rules less costly for companies, as many would be already be required to provide these disclosure elsewhere, but that it would also be important for the SEC to ensure that the reporting under these new rules would be accurate.

Despite speculation that the finalized rule will be released next month, Gensler said “we’re not doing this against the clock. When the staff is ready and when the Commission is ready.” In his testimony, Gensler said that the Commission received 16,000 comments regarding the proposed rules.