Sustainable Fund Flows Continue to Show Resilience

End of Week Notes

And a must-read on how CRT is morphing into anti-ESG/”woke” capitalism

To say this year has been a challenging one for sustainable funds may be an understatement. The growth of sustainable funds’ assets in the U.S. over the past several years occurred in a generally bullish environment in which most sustainable funds outperformed. But this year, both stock and bond markets have suffered deep losses, many sustainable funds have underperformed, and the field has faced well-publicized attacks from the political Right.

Against that backdrop, it wouldn’t be surprising to see investors fleeing from sustainable funds in large numbers. But that hasn’t happened. Sustainable fund flows have shown remarkable resilience this year.

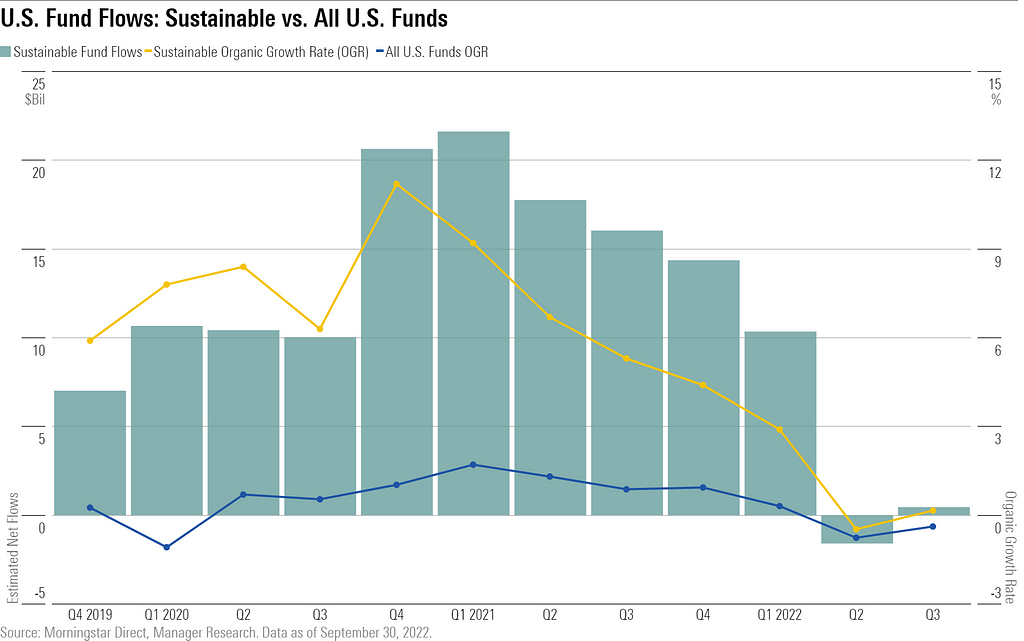

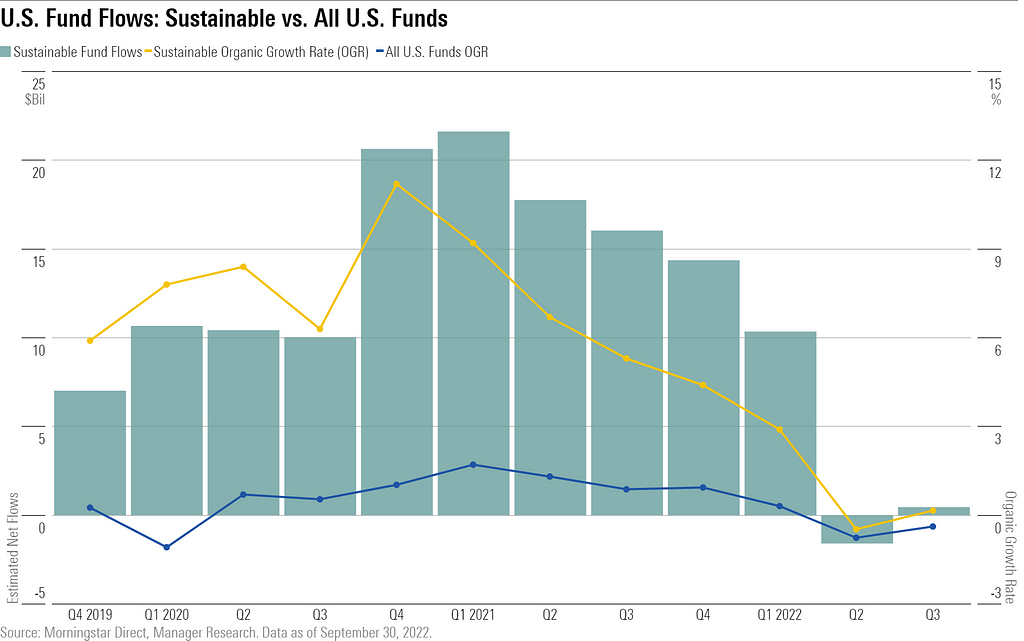

With both stock and bond markets deep in the red, U.S. investors have pulled money out of open-end and exchange-traded funds for the year to date. Through September, funds had outflows of $199 billion, according to Morningstar estimates. Sustainable funds, by contrast, have had inflows of $8.6 billion.

Same story for the third quarter. Sustainable funds had net inflows of $459 million. That’s a modest number in itself, as the bear market continued to suppress flows. But the overall universe of open-end and exchange-traded funds available to U.S. investors had net outflows of $86 billion.

Take a look at all the details in this piece by my colleague Alyssa Stankiewicz:

Sustainable Fund Flows Shine Bright in a Dismal Third Quarter for U.S. Funds

I have two takeaways, one of which is identical to what I wrote at mid-year:

Sustainable investors may be more likely to stay the course during tough markets. That’s a hard thing for many investors to do. But perhaps sustainability forges a stronger connection between investors and their investments that keeps them focused on the long term. If investors feel their investments are also seeking to generate positive outcomes beyond investment returns, that’s another reason to stick with those investments when markets go south.

The second has to do with the effects of the attacks on ESG coming from the political Right. Considering the source, the anti-ESG campaign may be reinforcing the investment decisions made by sustainable investors rather than causing them to question the concept.

Therein also lies an opportunity for sustainable funds to attract even more investors, on the theory that negative publicity is still, in the end, calling attention to the topic. It seems likely to cause at least some of the many people who are interested in sustainability to want to hear the other side of the story.

And when they hear that side of the story, it resonates while also exposing the anti-ESG position to be serving overtly political goals. The Right’s anti-ESG rhetoric ultimately may be more of a help than a hindrance to sustainable investing.

More on who is behind the anti-ESG campaign

I wrote about Leonard Leo, former leader of the Federalist Society, two weeks ago, and his efforts to fund the Right’s anti-ESG campaign. This week, we have a Bloomberg article on a guy named Christopher Rufo, said to be the man who “invented the conflict over critical race theory.”

Anti-Woke Activist Christopher Rufo Has Companies Like Disney Running Scared — Bloomberg

Now Rufo, according to Bloomberg, has set his sights on so-called “woke” capitalism, which goes hand-in-glove with the anti-ESG campaign. He is said to be the architect behind Florida Gov. Ron DeSantis’s assault on Walt Disney earlier this year. Indeed, the article reports, DeSantis and other Republicans are considering running for President “with an anti-corporate strategy based on Teddy Roosevelt’s war on giant corporations, but this time focused on concentrations of cultural power, particularly in the hands of media and tech companies, rather than concentrations of ownership.”

Rufo’s MO is to scour the corporate landscape for instances of “wokeness” that are sure to outrage conservatives.

“He then publicizes his best scoops on social media — his aim is to produce one big story a week — which is then taken up by mainstream conservative media, not least Fox News, and then bleeds into the rest of the media.”

The objective of all this is to intimidate corporations and asset managers into dropping ESG and keeping quiet on these issues. But, as I’ve said before, they can’t do it. Rufo and his ilk live in an ideological world.

Asset managers live in the real world where climate change is a material risk. To do their jobs properly, they need to know how companies plan to mitigate that risk and which ones are positioned to benefit from the inevitable transition to a low-carbon economy.

Corporations live in the real world of workforce diversity, both among their existing employees and those they wish to attract in the future. To attract the most talented, innovative and committed employees that are more crucial than ever to a firm’s success, they must be attuned to diversity issues, not ignore them.

To be sure, any given asset manager can decide for itself whether to consider climate and other ESG-related issues, and corporations can decide for themselves how to handle these issues, as well. But it never seems like a good thing to deny facts on the ground over an ideological predisposition.

Follow me on Twitter @Jon_F_Hale

Sustainable Fund Flows Continue to Show Resilience was originally published in The ESG Advisor on Medium, where people are continuing the conversation by highlighting and responding to this story.