UK retail sustainable fund changes: Assessing the impact of SDR in the first half of 2025

If you have found your head somewhat spinning when thinking about sustainable investment (and related) fund options recently you are not alone…

The following analysis highlights changes in UK the sustainable, responsible and ethical fund market during the first half of 2025, when the Sustainability Disclosure Regime (SDR)’s naming and marketing rules came into force. So far this year we have seen SDR labelling increase, portfolio labelling paused by the regulator – and geopolitics generally throwing a wide range of spanners into the works.

This information is taken from our (free to use) retail sustainable investment fund database Fund EcoMarket, which aims to list all relevant options in that area. Fund EcoMarket currently lists 1,249 sustainable, responsible and ethical funds and portfolios across various retail product options.

Additions and removals:

During the first half of the year, 10 new entries were added:

- 1 Oeic, 3 SICAVs, 1 Investment Trust, 2 Pensions, 2 VCT/EIS/SEIS, 1 ‘other’

95 relevant investment options closed and/or were removed from the front end of Fund EcoMarket following instructions from managers, the product split was:

- 27 Oeics

- 17 SICAVs

- 10 Investment Trusts

- 13 ETFs

- 11 Life

- 16 Pensions

- 0 DFM

- 1 VCT/EIS/SEIS

There were also 285 name changes between January and June, made up of:

- 88 Oeics

- 62 SICAVs

- 1 Investment Trusts

- 49 ETFs

- 1 Charities

- 25 Life

- 59 Pension

- 0 DFM

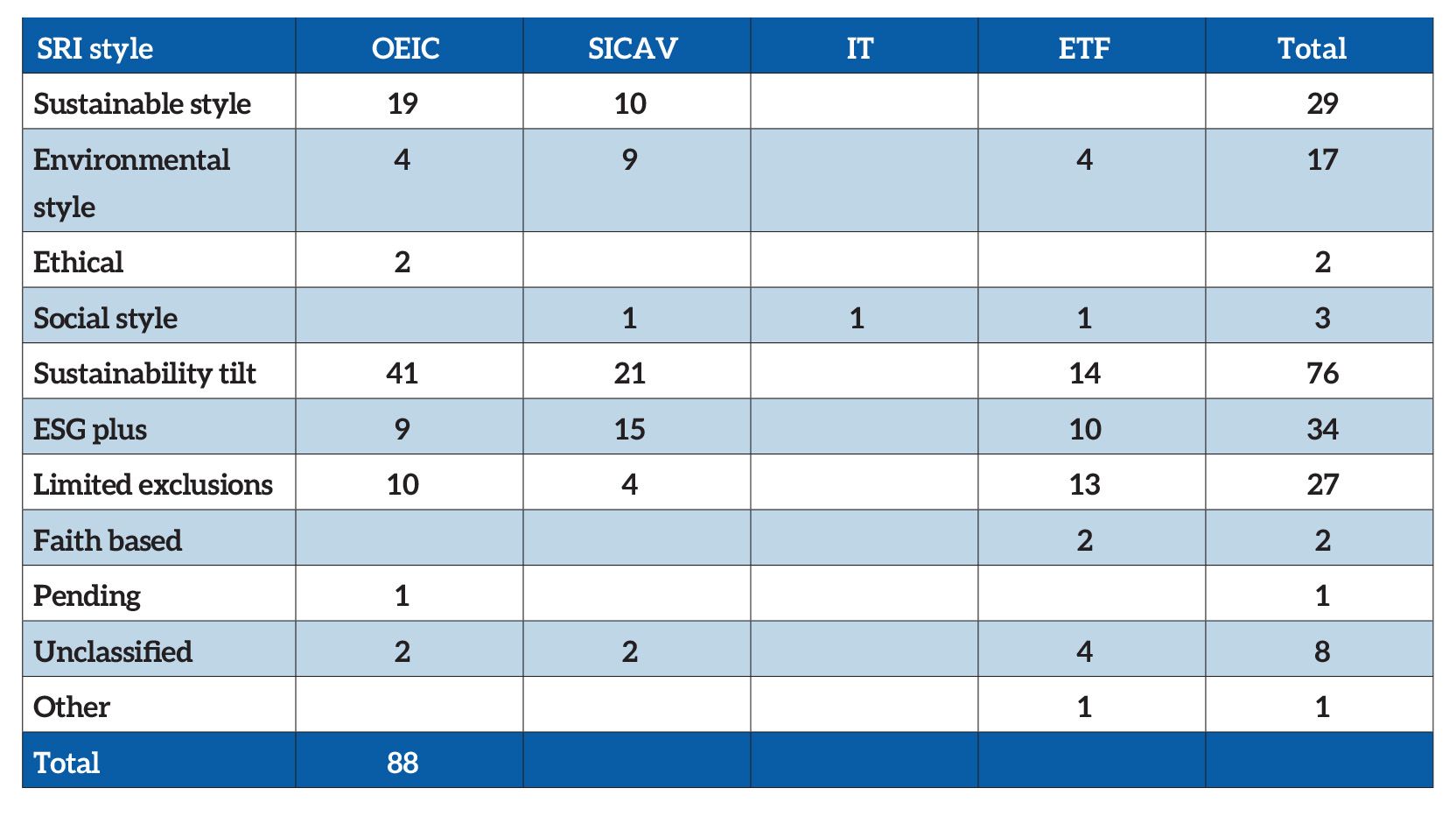

Mapping these name changes to strategy differences and product areas threw up some interesting findings.

We have been segmenting funds in this area according to their core sustainability/ethical characteristics – using our SRI Styles fund classification methodology – for over 15 years. Its purpose is to help advisers and wealth managers understand core fund differences – both in terms of the issues funds focus on and their broad approach.

Name changes mapped to product and strategy variations

Funds with a ‘sustainability tilt style’ have been significantly impacted

Analysis of the changes made this year showed that 76 of the funds we regard as having a ‘Sustainability tilt’ SRI Style changed their names Q1/2 2025. These are funds that we regard as ‘mid-market’ – as they focus on underweight/overweighting led sustainability strategies – often alongside stewardship activity. (This is out of the 96 Oeicss, 56 SICAVs and 36 ETFs listed within that style).

This points to the significant impact of SDR rule changes on tilted type funds – as over three quarters of ‘Sustainability tilt’ style Oeics and SICAV’s options that we list have changed their names this year. This is not a surprise – but it is interesting to see the data.

These are, however, by no means the only funds that were impacted.

Funds that we classify as ‘Sustainable style’ (ie with a clear and significant emphasis on sustainability issues and or outcomes) were also impacted. Nineteen of 88 Oeics in that style changed their names also (just under one in five).

See also: Introducing BSI PAS 7342 – the new sustainable fund standard

SDR labels snapshot

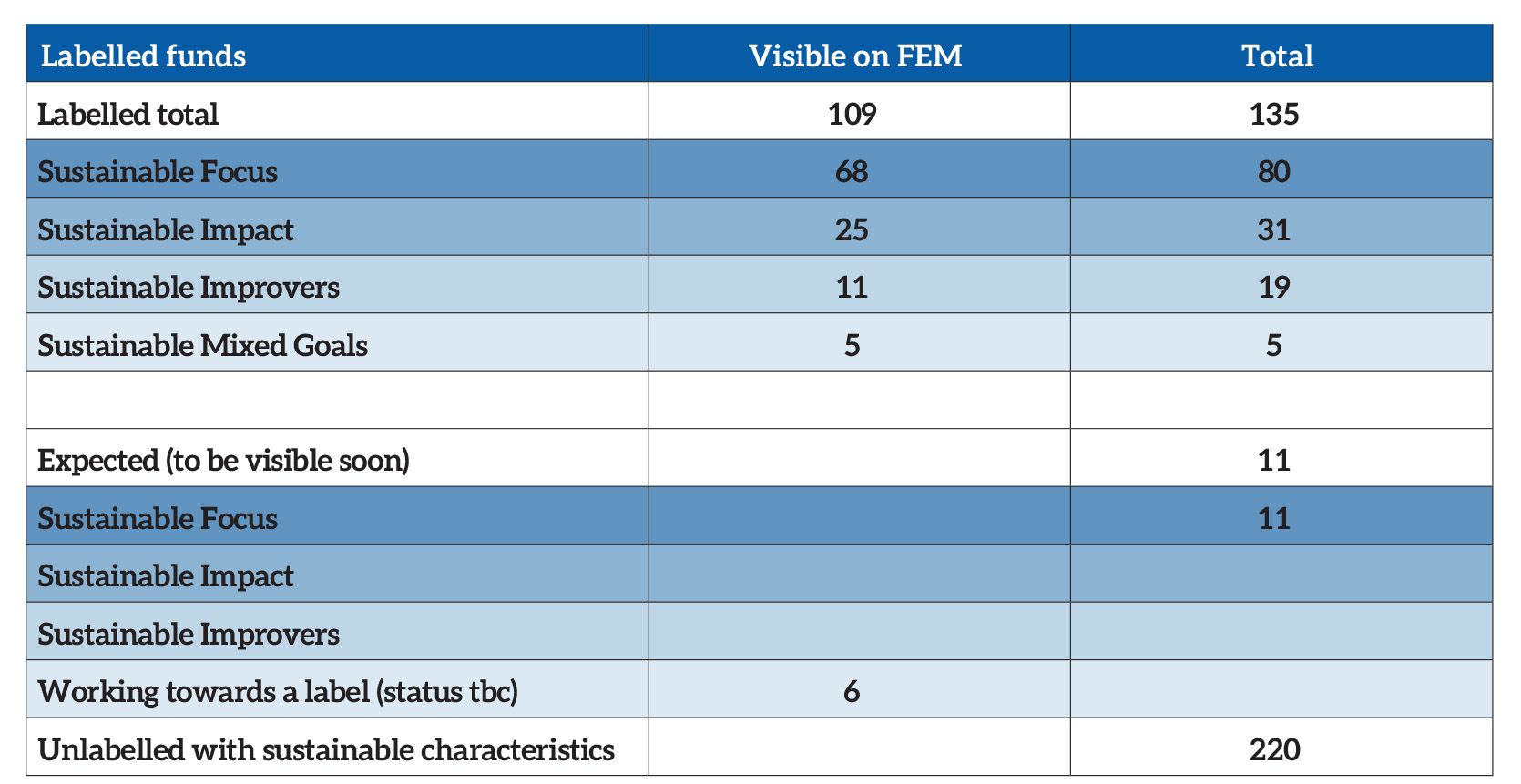

Our research indicates the following numbers of funds with SDR labels.

The two columns show options that are ‘Visible on Fund EcoMarket’ (names that are public knowledge) and ‘Total’ (this includes the funds that are visible plus those that are currently being held back by fund managers):

Probably the most important data from the above table is:

- SDR labelled funds – 109 are currently visible on the front end of Fund EcoMarket – ie currently being used by fund managers.

- This number rises to 135 in total when we include options that are not yet being publicised by fund managers.

- Unlabelled with sustainability characteristics: 208 additional fund options are currently visible on the front end of Fund EcoMarket that have opted for the ‘unlabelled’ SDR category. These funds are likely to be relevant to clients with an interest in this area – but have chosen not to adopt a label.

- In total we know of 220 funds of this kind (12 are not yet publicly displayed).

The ‘Unlabelled with sustainability characteristics’ segment is diverse. (This group are required to publishe the same SDR disclosures as labelled funds). Mapping these to our SRI Styles classification system shows the following:

- 24 ‘unlabelled’ options are funds that we classify as ‘Ethical’ – a cohort that has always given serious consideration to environmental and social issues, and so (theoretically at least) could be brought into the labelling regime.

- 65 ‘unlabelled’ options are funds that we classify as ’Sustainability Tilt’ – a cohort I would suggest includes options that could apply for an SDR label (perhaps ‘Improver’) – if agreement can be reached.

- 19 ‘unlabelled’ options are funds that we classify as ‘ESG Plus’ – meaning that they lean into ESG risk management, alongside having additional sustainability characteristics. Again, I would suggest that at least some of these could achieve labels – if regulators and fund managers can find a way through.

What does this mean for financial advisers, planners, wealth managers and commentators?

In brief – quite a lot. Before SDR landed in November 2023, we knew there were issues with trust in this area, and that guardrails were needed. The rules designed to address this are increasingly taking effect.

The rules may be overly complex and imperfect in places (notably the labelling implementation), but there are positives.

Fund managers have responded in a range of ways – based on their strategies and engagement with the FCA’s complex labelling implementation process.

This makes it difficult for intermediaries and clients to understand this area a present, however it is still early days.

One area to think about might be the 40 funds that we classify as ‘Sustainability Style’ ie where a fund’s interest in sustainability is clear, and deep – however the managers have not adopted a label (yet). In most cases these will be serious options that align to the purpose of SDR, if not the way it is being implemented. These funds will have designed for clients with a significant interest in sustainability.

A further complication for intermediaries is that SICAVs and portfolios remain out of scope of SDR – both of which will be addressed over time. As such, it remains vital that intermediaries look at labelled, unlabelled and out of scope funds when researching funds for clients with an interest in sustainability. When you see that a fund has an SDR label it tells you a great deal – however the lack of a fund label does not, in practice, mean much just yet.

And it is also important to remember that irrespective of labelling status – these funds vary significantly. The FCA does not dictate where these funds can invest. Not all will, for example, exclude coal, oil and gas majors, have biodiversity strategies, measure positive impacts and or exclude weapons. So please do not ‘assume’.