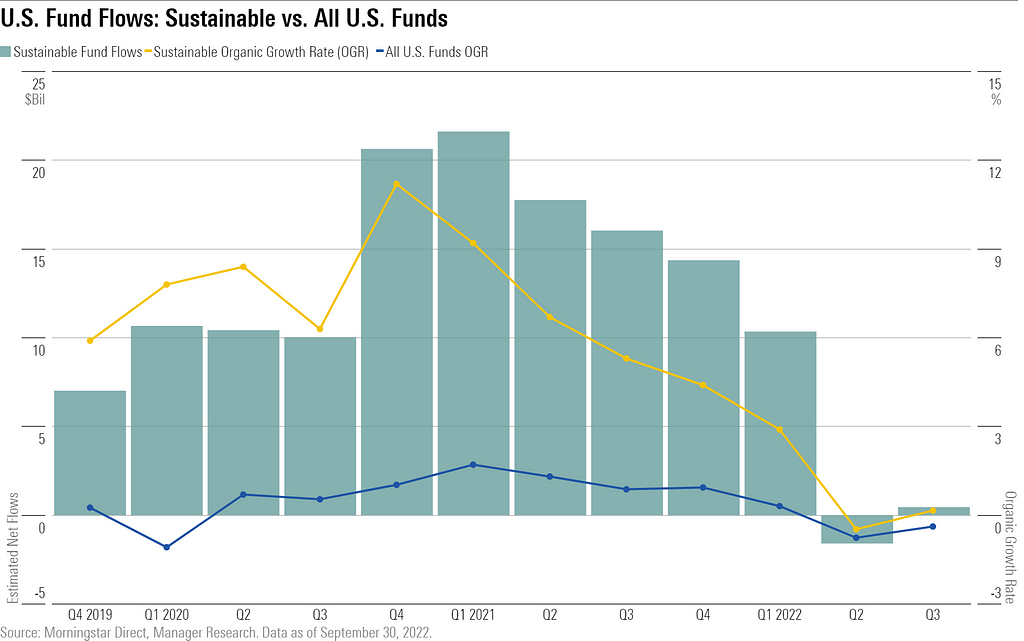

End of Week Notes And a must-read on how CRT is morphing into anti-ESG/”woke” capitalism To say this year has been a challenging one for sustainable funds may be an understatement. The growth of sustainable funds’ assets in the U.S. over the past several years occurred in a generally bullish environment in which most sustainable funds outperformed. But this year, both…